At Insider Monkey, we pore over the filings of nearly 867 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30th. In this article, we will use that wealth of knowledge to determine whether or not Zynga Inc (NASDAQ:ZNGA) makes for a good investment right now.

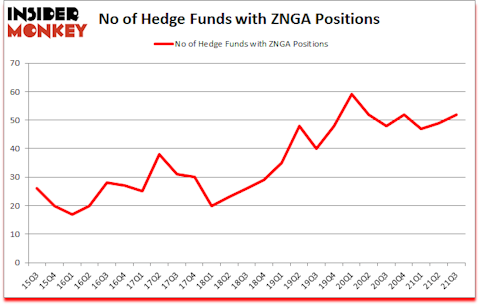

Is Zynga Inc (NASDAQ:ZNGA) the right investment to pursue these days? Money managers were in an optimistic mood. The number of long hedge fund positions rose by 3 in recent months. Zynga Inc (NASDAQ:ZNGA) was in 52 hedge funds’ portfolios at the end of September. The all time high for this statistic is 59. Our calculations also showed that ZNGA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). There were 49 hedge funds in our database with ZNGA holdings at the end of June.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the recent hedge fund action encompassing Zynga Inc (NASDAQ:ZNGA).

Do Hedge Funds Think ZNGA Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2021, a total of 52 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ZNGA over the last 25 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Zynga Inc (NASDAQ:ZNGA) was held by Corvex Capital, which reported holding $67.9 million worth of stock at the end of September. It was followed by Iridian Asset Management with a $49.2 million position. Other investors bullish on the company included Point72 Asset Management, Parsifal Capital Management, and Discovery Capital Management. In terms of the portfolio weights assigned to each position Tiger Legatus Capital allocated the biggest weight to Zynga Inc (NASDAQ:ZNGA), around 6.75% of its 13F portfolio. Blue Grotto Capital is also relatively very bullish on the stock, dishing out 5.23 percent of its 13F equity portfolio to ZNGA.

As aggregate interest increased, specific money managers have jumped into Zynga Inc (NASDAQ:ZNGA) headfirst. Greenhouse Funds, managed by Joe Milano, created the most valuable position in Zynga Inc (NASDAQ:ZNGA). Greenhouse Funds had $34.2 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $24.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Keith Meister’s Corvex Capital, and Richard Mashaal’s Rima Senvest Management.

Let’s check out hedge fund activity in other stocks similar to Zynga Inc (NASDAQ:ZNGA). We will take a look at The Western Union Company (NYSE:WU), Sealed Air Corporation (NYSE:SEE), Under Armour Inc (NYSE:UA), Rexford Industrial Realty Inc (NYSE:REXR), Phillips 66 Partners LP (NYSE:PSXP), The Scotts Miracle-Gro Company (NYSE:SMG), and Ralph Lauren Corporation (NYSE:RL). This group of stocks’ market values are similar to ZNGA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WU | 27 | 234768 | -4 |

| SEE | 33 | 626876 | 5 |

| UA | 48 | 1643556 | -3 |

| REXR | 29 | 358442 | 8 |

| PSXP | 5 | 31682 | 0 |

| SMG | 30 | 257473 | -2 |

| RL | 25 | 444724 | -7 |

| Average | 28.1 | 513932 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.1 hedge funds with bullish positions and the average amount invested in these stocks was $514 million. That figure was $604 million in ZNGA’s case. Under Armour Inc (NYSE:UA) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Zynga Inc (NASDAQ:ZNGA) is more popular among hedge funds. Our overall hedge fund sentiment score for ZNGA is 84.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Unfortunately ZNGA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ZNGA were disappointed as the stock returned -19.9% since the end of the third quarter (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Zynga Inc (NASDAQ:ZNGA)

Follow Zynga Inc (NASDAQ:ZNGA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 Worst Major Cities for Allergies in 2020

- 25 Best Heist Movies of All Time

- 15 Biggest Private Equity Firms In The World

Disclosure: None. This article was originally published at Insider Monkey.