Altai Capital sent the following letter to Amber Road Inc (NYSE:AMBR)’s board earlier this week.

After reading the letter we got the impression that Amber Road’s management isn’t doing what it can do to maximize shareholder value and needs to go. In the letter Altai Capital makes its case for the following statements:

– Poor operational execution has caused Amber Road’s stock price to decline over 50% since its 2014 initial public offering (“IPO”)

– Amber Road lacks both the scale and the profitability to be valued highly as a stand-alone company;

– Amber Road is underfunded, leaving it bereft of growth capital and vulnerable to an economic downturn;

– While Amber Road’s shareholders have suffered significant value destruction, the Board has paid Chief Executive Officer James Preuninger over $9 million since Amber Road’s IPO; and

– Despite refusing to engage with E2open, which offered $10.50 per share (the “Offer Price”) to acquire Amber Road in February of this year (a 52% premium to the share price at the time of the offer and a 27% premium to Amber Road’s closing share price on December 14, 2018), Amber Road management continues to sell their own shares in the open market at prices below the Offer Price.

Let us explain we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a peek at the key hedge fund action regarding Amber Road Inc (NYSE:AMBR) before talking about which two questions you need to answer affirmatively before buying the stock.

How are hedge funds trading Amber Road Inc (NYSE:AMBR)?

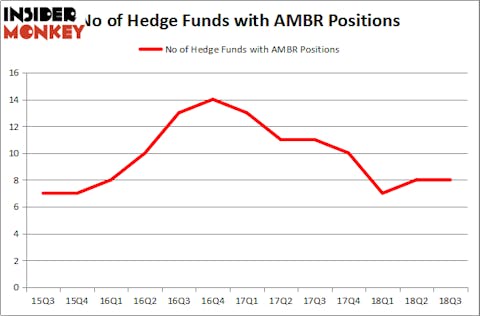

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in AMBR heading into this year. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Royce & Associates held the most valuable stake in Amber Road Inc (NYSE:AMBR), which was worth $16.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $9.5 million worth of shares. Moreover, D E Shaw, Two Sigma Advisors, and Millennium Management were also bullish on Amber Road Inc (NYSE:AMBR), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Boardman Bay Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Marshall Wace LLP).

Let’s now take a look at hedge fund activity in other stocks similar to Amber Road Inc (NYSE:AMBR). We will take a look at BlackRock MuniYield Quality Fund II, Inc. (NYSE:MQT), Natural Health Trends Corp. (NASDAQ:NHTC), New Age Beverages Corporation (NASDAQ:NBEV), and North American Energy Partners Inc.(USA) (NYSE:NOA). This group of stocks’ market caps are similar to AMBR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MQT | 1 | 820 | 0 |

| NHTC | 9 | 34115 | 3 |

| NBEV | 1 | 90 | 0 |

| NOA | 5 | 43287 | 1 |

| Average | 4 | 19578 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $32 million in AMBR’s case. Natural Health Trends Corp. (NASDAQ:NHTC) is the most popular stock in this table. On the other hand BlackRock MuniYield Quality Fund II, Inc. (NYSE:MQT) is the least popular one with only 1 bullish hedge fund positions. Amber Road Inc (NYSE:AMBR) is not the most popular stock in this group but hedge fund interest is still above average.

Overall, though, most of these hedge funds are quant hedge funds, not activist investors. We aren’t very confident about Altai Capital’s ability in waging a successful proxy battle and ousting the company’s management. So, the first question that you need to answer is whether Altai Capital can oust the management.

The market conditions changed dramatically. Tech valuations came down and “buy the dip” mentality was replace with “sell the relief rally”. We aren’t sure that E2open or any other buyer would be interested in buying the company for $10.50 a share at this point in time. So, this is the second question you need to answer before buying this stock.

What would we do? We would stay away from Amber Road Inc (NYSE:AMBR). There are a lot of stocks in the market with better risk-return characteristics that don’t require a “white knight” saving the company.

Disclosure: None. This article was originally published at Insider Monkey.