The stock of Xoom Corp (NASDAQ:XOOM), the global online money transfer provider skyrocketed during its initial public offering (IPO) last Friday. The stock opened at $21 per share, 31 percent higher than its offering price at $16 per share. Xoom’s stock price further soared by the end of the trading day by almost 60 percent to more than $25 per share. Investors definitely showed their confidence in the company, but the question is Will XOOM continue to go sky-high?

During its debut, Xoom offered more than 6.3 million shares, which include more than 5.2 million shares by the company and over 1.1 million shares offered by selling stockholders. The company plans to use the funds generated from its public offering for general corporate purposes including the purchase of businesses, technologies, and other assets to complement its business operation. It has more than 31 million outstanding shares.

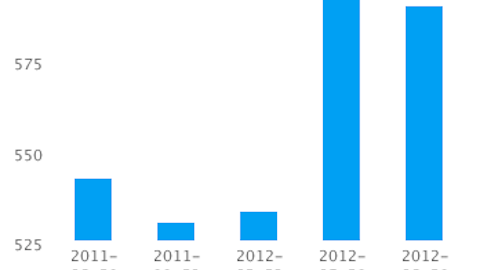

Xoom generates revenue from transaction fees charged to customers and foreign exchange spreads (target 1% to 3% of a transaction’s principal amount) where the payout currency is not the dollar. The company incurred operating losses since its inception with an accumulated deficit of $63.4 million as of December 2012. The company made long-term investments in service innovations, technology infrastructure & solutions; marketing to increase brand awareness, and international expansion to ensure revenue growth in the future. Take note that since 2008, its revenue climbed steadily from 14.1 million to $80 million in 2012, a 54% CAGR.

Xoom provides money transfer to customers in 30 countries though its website and mobile services. In 2011 & 2012, a majority of its total revenue is generated from India and the Philippines. Since 2008, its gross sending volume grew from $245 million to $2.3 billion in 2012.

Xoom has established global partnerships with a network of banks and major retailers with trusted brands in the industry. The company processes transactions with a high level of risk management, compliance, regulatory oversight and customer service. Currently, Xoom has 750,000 active customers who send remittances to their family and love ones. Xoom’s customers trust its money transfer service because it is convenient, fast, and charges lower transaction fees than its competitors. Customers fund their transactions through a U.S. based bank account, credit card or debit card. According to the company, 90% of its gross sending volume is funded by bank accounts through the Automated Clearinghouse (ACH) System. Customers have the ability to track their transaction in real-time, and they can choose different options on how their recipients will receive their money. Its proprietary risk management system is balanced with low-friction experience and a low transaction loss rate.

Data from the World Bank Migration and Development Brief, the worldwide remittance market is expected to grow from $513 billion in 2011 to $685 billion in 2015, which meansa global money transfer is a huge and a growing industry. Many people particularly professional & skilled workers from developing countries migrate to developed countries such as the United States, which is the largest recipient of migrants from developing countries, and the largest sender of remittances. Remittance flows to developing countries is expected to increase from $406 billion to $534 billion in 2015. The highest recipients of migrant remittances include India, China, Philippines, and Mexico.

At present, Xoom does not have a business presence in 7 of the top 10 recipients of migrant remittances. Its current market share in the industry is only 4 percent. Considering the fact that the global money transfer industry is huge, Xoom has a lot of room to grow. However, it needs to ensure that it has the capability to compete with its rivals in the industry including Moneygram International Inc (NYSE:MGI) and The Western Union Company (NYSE:WU).