A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Xenon Pharmaceuticals Inc (NASDAQ:XENE).

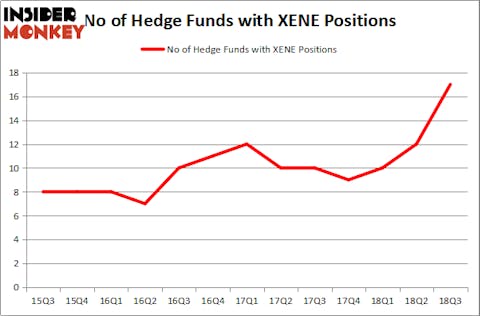

Is Xenon Pharmaceuticals Inc (NASDAQ:XENE) an outstanding investment today? Investors who are in the know are turning bullish. The number of bullish hedge fund positions improved by 5 lately. Our calculations also showed that XENE isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the latest hedge fund action encompassing Xenon Pharmaceuticals Inc (NASDAQ:XENE).

Hedge fund activity in Xenon Pharmaceuticals Inc (NASDAQ:XENE)

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 42% from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in XENE heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Xenon Pharmaceuticals Inc (NASDAQ:XENE) was held by venBio Select Advisor, which reported holding $31.2 million worth of stock at the end of September. It was followed by Adage Capital Management with a $15.8 million position. Other investors bullish on the company included Biotechnology Value Fund / BVF Inc, Broadfin Capital, and Citadel Investment Group.

As industrywide interest jumped, key money managers have jumped into Xenon Pharmaceuticals Inc (NASDAQ:XENE) headfirst. Broadfin Capital, managed by Kevin Kotler, initiated the most valuable position in Xenon Pharmaceuticals Inc (NASDAQ:XENE). Broadfin Capital had $11.8 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $10 million investment in the stock during the quarter. The following funds were also among the new XENE investors: James A. Silverman’s Opaleye Management, Kamran Moghtaderi’s Eversept Partners, and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks similar to Xenon Pharmaceuticals Inc (NASDAQ:XENE). We will take a look at Affimed NV (NASDAQ:AFMD), American Realty Investors, Inc. (NYSE:ARL), Pioneer High Income Trust (NYSE:PHT), and Barnes & Noble Education Inc (NYSE:BNED). This group of stocks’ market values resemble XENE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFMD | 10 | 34441 | 2 |

| ARL | 1 | 670 | 0 |

| PHT | 1 | 93 | 0 |

| BNED | 15 | 46205 | 0 |

| Average | 6.75 | 20352 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $129 million in XENE’s case. Barnes & Noble Education Inc (NYSE:BNED) is the most popular stock in this table. On the other hand American Realty Investors, Inc. (NYSE:ARL) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Xenon Pharmaceuticals Inc (NASDAQ:XENE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.