Michael Ciarmoli: Hey, good evening guys. Thanks for taking the questions. Just some general follow-ups here, maybe Mark and Chip. Just to be clear, the past due from the supply chain, that’s all included in the guidance. So even if you sort of catch up, that wouldn’t maybe drive upside, but it would put you at the higher end of the guidance? Is that how we should think about kind of liquidating that balance?

Chip Blankenship: I think the short answer is yes. We’ve assumed a certain amount of progress on eliminating past dues, but not completely. And if we can get more traction operationally earlier, we can eat into that more and head towards the high range of the sales number.

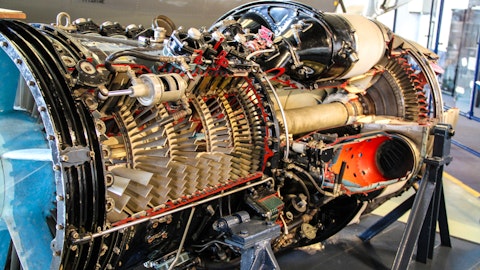

Michael Ciarmoli: Got it. And then just in terms of raw materials and other kind of choke points, I know at one point, I think you were having issues sourcing an aluminum billet for the fuel metering. Are you sort of caught up there? Or do you have that part of the supply chain rectified?

Chip Blankenship: Yes. Thank goodness. We do have plenty of 6061 billet there in Rockford and the line is what we call wetted. So every station has the work in front of it. And for now, we’ve mitigated some of our risk by expanding our sources for the billet and we’re continuing to watch that very carefully. We’re highly vertically integrated there in that plant. That’s one of the last places I’d expect the supply chain issues to challenge us, but it did earlier in the year. But as of now, we’ve got plenty of material in front of the line.

Michael Ciarmoli: Got it. And then just the last one, I guess, you talked about the insourcing and some of the capital being spent. Are there any qualification or requalification requirements that you have to go through? And then I guess, should we €“ some of the insourcing as that ramps up and maybe new equipment sort of comes online. Is there any margin impact in either of the segments? And I guess I’ll even throw in, you talked about some of these carbon emission projects. Or should we be thinking about that as sort of maybe a modest headwind to margins, just everything you’re spending on?

Chip Blankenship: So I wouldn’t think of the decarbonization, emissions improvement, alternate fuel projects has any impact on margins. That’s €“ R&D is factored into the plan and the guidance that we’ve given on that. The other question was on €“ I think about insourcing. That activity should improve margins, and that’s factored into our overall 100 basis point improvement for the year. The other thing to think about there is many of these parts we’ve made before, so — and we outsourced to maybe five or 10 years ago in some cases. And so we still maintain a qualification. What we’ll have to do is run off some parts on the actual machine that we put on the ground and in the parts that we choose, we’ll choose that we have design control over, and we’ve made before €“ we made like parts before to minimize that cycle.

Michael Ciarmoli: Got it. That makes sense. Perfect. Thanks guys.

Chip Blankenship: You’re welcome.

Operator: We have no further questions at this time. We’ll turn it over to Chip Blankenship for any closing comments.

Chip Blankenship: Just like to thank everybody for joining us today. Good questions and good dialogue. We’ll look forward to seeing you next time.

Operator: Ladies and gentlemen, this concludes today’s conference call. Thank you for participating, and you may now disconnect.

Follow Woodward Inc. (NASDAQ:WWD)

Follow Woodward Inc. (NASDAQ:WWD)

Receive real-time insider trading and news alerts