Chip Blankenship: I feel like it’s — we’re not metered by demand. We’re metered by our ability to produce units. A lot of this demand is in some cases dropping in inside lead time and we’re trying to manage with our customers how to make promises and keep them and they can count on our delivery forecast. So really a lot of the constraint is us, as well as some FX headwind on the top line from a dollar standpoint.

Pete Skibitski: Right. Okay. That’s helpful. Last one for me just on the $95 in COVID disruption, it’s helpful to see kind of by segment here. It seems like for a year, Aerospace has gotten better and you’ve had less issues there through this quarter where industrials actually got worse. Could you maybe — is there anything that you haven’t touched on in industrial that’s kind of leading to that performance falling behind?

Mark Hartman: Yes. So you’re right, Pete, that Aerospace did get slightly better in the quarter and industrial did get worse. As Chip was just talking about really the supply chain and labor disruption got worse on industrial, really related to the demand. The customer order volume continues to be strong and so that demand is still there. It’s still — we’ve talked previously that the electronics availability is still limited in our output capability on the industrial side is one of the big drivers and the other is the machine components and it’s still both of those is what’s driving that increase based on their availability.

Pete Skibitski: Okay. Components less so than labor?

Mark Hartman: Well, there’s a labor factor of this across the board in that $60 million both from our supply chain availability and getting our — the labor that we brought in, trained and improving output on the line.

Pete Skibitski: Okay. Thanks guys.

Chip Blankenship: You bet.

Mark Hartman: Welcome.

Operator: Your next question comes from the line of Christopher Glynn with Oppenheimer. Your line is now open.

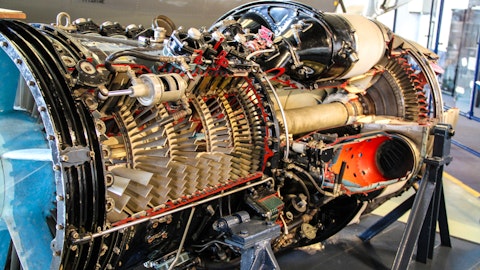

Christopher Glynn: Hey, thanks. Good evening. Wanted to ask about some of the incremental strength in industrial turbomachinery. Are there any positive inflections you’re seeing more pronounced now? Relative to the past few quarters, maybe certain process verticals stepping out, kind of, investment mode?

Chip Blankenship: I don’t know that we see all the way through to the exact end market application that you’re asking at the end of your question. But for us, we see a — just a definite step function in OEM demand for land-based gas turbine-controlled accessories that we provide. So that’s where the bulk of that increase is coming from for Woodward. Yes, there’s the — we can postulate that it’s this splits between power generation and an oil and gas process, but we’re not sure.

Christopher Glynn: Okay, great. And as you look at the supply chain and labor outlook to subset, the issue is to subside. Or to begin to subside in your back half. Is there one where, you know, you have more certain visibility, you know, you’ve made some real investments. Where are you starting to see the traction, where you have more of a tighter timeline?