Woodward, Inc. (NASDAQ:WWD) Q1 2023 Earnings Call Transcript January 30, 2023

Operator: Thank you for standing by. Welcome to the Woodward, Inc. First Quarter Fiscal Year 2023 Earnings Call. At this time, I’d like to inform you that this call is being recorded for rebroadcast and then all participants are in a listen-only mode. Following the presentation, you are invited to participate in a question-and-answer session. Joining us today from the company are Mr. Chip Blankenship, Chairman and Chief Executive Officer; Mr. Mark Hartman, Chief Financial Officer; and Mr. Dan Provaznik, Director of Investor Relations. I’d now like to turn the call over to Mr. Provaznik.

Dan Provaznik: Thank you, operator. We would like to welcome all of you to Woodward’s first quarter fiscal year 2023 earnings call. In today’s call, Chip will comment on our strategies and related markets. Mark will then discuss our financial results as outlined in our earnings release. At the end of the presentation, we will take questions. For those who have not seen today’s earnings release, you can find it on our website at woodward.com. We have included some presentation materials to go along with today’s call that are also accessible on our website. An audio replay of this call will be available by phone or on our website through February 13, 2023. The phone number for the audio replay is on the press release announcing this call, as well as on our website and will be repeated by the operator at the end of the call.

I would like to refer to and highlight our cautionary statement as shown on slide three. As always, elements of this presentation are forward-looking or based on our current outlook and assumptions for the global economy and our businesses more specifically, including the expected and potential effects of the ongoing supply chain and labor disruptions and net inflationary pressures. Those elements can and do frequently change. Our forward-looking statements are subject to a number of risks and uncertainties surrounding those elements, including the risks we identify in our filings with the SEC. In addition, Woodward is providing certain non-U.S. GAAP financial measures. We direct your attention to the reconciliations of non-U.S. GAAP financial measures, which are included in today’s slide presentation and our earnings release and related schedules.

We believe this additional financial information will help in understanding our results. And now I will turn the call over to Chip.

Chip Blankenship: Thank you, Dan, and good afternoon, everyone. Our first quarter earnings were in line with our expectations, although our Industrial segment had a challenging quarter. We continue to see strong demand from our end markets. The ongoing industry-wide challenges from supply chain and labor disruptions and inflation impacted profitability in the quarter as we anticipated and negatively affected our cash flow. These supply chain and labor disruptions are anticipated to begin to subside in the second half of the fiscal year as our strategic investments and mitigation actions translate into improved financial results. Our past due commitments to customers remain elevated as a result of the supply chain and labor challenges, but also because of sustained strong demand.

We continue to focus our efforts on improving our supply chain by securing additional capacity with trusted suppliers. Making strategic investments into the creation of rapid response centers and maximizing our current machining capabilities to increase deliveries to customers. In addition, we continue to focus on developing and retaining talent. I’d like to recognize our Woodward members, who are working hard to serve customers better and improve our company’s results. During the quarter, we announced streamlined Aerospace and Industrial organization structures with leadership designed to enhance the sales experience for customers, simplify operations, and increased profitability through improved execution. Within the Aerospace segment, this new structure enables advancement of our missiles and space programs.

In December, Randy Hobbs joined Woodward as President of our Industrial segment. Randy is an accomplished executive with significant global leadership and lean manufacturing, lean enterprise management expertise. Randy and I are working closely to transform Woodward’s Industrial segment as significant changes required. He is already driving multiple initiatives to improve our operational execution. We have three priorities in addition to accelerating operational recovery. First is rightsizing the business and improving our cost structure. We are already well on that path with the announced consolidation of Engine Systems and Turbine Systems business units inside the Industrial segment. Second is pricing. We are executing multiple work streams to capture prices that reflect the value we deliver.

And third is product portfolio rationalization, which will reduce complexity and maximize profitability over the longer term. I’m confident in Randy’s ability to lead this segment and improve near-term operational results, as well as improve long-term returns for shareholders. I look forward to discussing our progress on these priorities during our next call. On a somewhat related note, we are moving the date of our June 2023 Investor Day to later in the calendar year. Our internal strategy work related to the transformation of the industrial segment is ongoing. We want to demonstrate progress and establish a firm foundation before we present our long-term targets for Industrial and the rest of the company. As we indicated in the last call, but were unable to name names, we are proud to announce that Woodward was selected to work with Airbus to provide the fuel cell balance of plant solution for the ZEROe demonstrator.

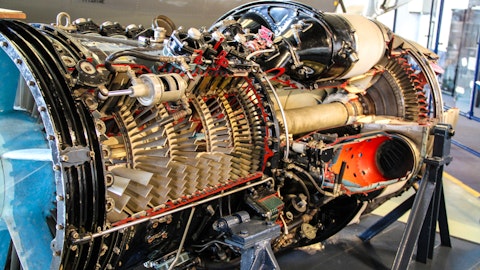

Photo by Guillaume Bolduc on Unsplash

This project leverages our leading fuel control technologies to enable a more sustainable form of air travel based on hydrogen propulsion. This Airbus demonstrator program aims to support ZERO emission aircraft development for entry into service by 2035. This project goes hand-in-hand with multiple carbon emissions reduction projects already underway at Woodward for Aerospace and Industrial end markets. Moving to our markets. In Aerospace, utilization rates for the commercial airline fleet continue to rise, driven by increasing global passenger traffic; U.S. And European domestic passenger traffic has returned to near 2019 levels. International travel continues to improve. Passenger traffic in China is increasing and we are pleased to see that the Boeing 737 MAX is beginning to fly in China again.

In the defense market, we are seeing U.S. procurement increase, while rising geopolitical tensions may lead to increased international defense spending. In Industrial markets, robust demand for power generation continues to be driven by strong growth in Asia, increases in global aftermarket activity and consistent demand for backup power at data centers. In Transportation, the global marine market remains healthy with increased ship build rates, higher utilization and elevated freight prices, all of which drive increases in current and future aftermarket activity. Ferry and cruise activity is near 2019 levels, which should result in increased spare parts demand. In addition, the global marine market continues to show increasing interest in alternative fuels as more projects are announced and under development.

Woodward content is greater on multi-fuel engines, which should enhance OEM and aftermarket activity in the future. On the other hand, demand in China for natural gas trucks remains at depressed levels. In the oil and gas market, elevated commodity prices continue to drive higher equipment utilization, which should in turn result in increased aftermarket demand. In summary, we anticipate continued market strength as heightened demand signals point to growth and opportunity for Woodward. We are committed to improving operational execution across the company, developing and retaining talent and innovation, all of which will position Woodward for long-term success and value creation for our shareholders. I will now turn over the call to Mark to review our quarterly results.

Mark Hartman: Thank you, Chip. Net sales for the first quarter of fiscal 2023 were $619 million, an increase of 14%. Sales growth for the quarter was driven by increased volume and price realization, but negatively impacted by approximately $95 million, due to the ongoing global supply chain and labor disruptions. Sales were also impacted by approximately $19 million, due to unfavorable foreign currency exchange rates. Net earnings were $30 million or $0.49 per share for the first quarter of 2023. For the first quarter of 2022, net earnings were $30 million or $0.47 per share and adjusted net earnings were $36 million or $0.56 per share. Aerospace segment sales for the first quarter of fiscal 2023 were $396 million, an increase of 18%.

Commercial OEM and aftermarket sales were up 32% and 47% respectively, driven by continued recovery in both domestic and international passenger traffic and increasing aircraft utilization. Segment sales were negatively impacted by $35 million in delayed shipments caused by global supply chain and labor disruptions. Defense OEM sales were down 15% in the quarter primarily due to lower sales of guided weapons. Defense aftermarket sales were flat. Aerospace segment earnings for the first quarter of 2023 were $55 million or 14.0% of segment sales, compared to $51 million or 15.2% of segment sales. The increase in segment earnings was primarily a result of price realization and higher commercial OEM and aftermarket volume. Segment earnings including as a percent of segment sales were negatively impacted by inflationary impacts on material and labor costs; increases in costs related to supply chain disruptions; inefficiencies related to training new hires; and the return of the annual incentive compensation.

Turning to Industrial. Industrial sales for the first quarter of fiscal 2023 were $223 million, compared to $205 million, an increase of 9%. The increase was primarily driven by higher marine sales from continued utilization of the in-service fleet and strong industrial turbomachinery sales supporting the increased demand for power generation and process industries. Segment sales were negatively impacted by approximately $60 million in delayed shipments caused by global supply chain and labor disruptions, as well as unfavorable foreign currency exchange rate impacts of approximately $17 million. Industrial segment earnings for the first quarter of 2023 were $11 million or 5.1% of segment sales, compared to $24 million or 11.5% of segment sales.

The decrease in segment earnings was primarily as a result of inflationary impacts on material and labor costs; increase in costs related to supply chain disruptions; inefficiencies related to training new hires, unfavorable foreign currency effects and the return of annual incentive compensation, all partially offset by higher sales volume and price realization. Non -segment expenses were $24 million for the first quarter of 2023. For the first quarter of 2022 non-segment expenses were $29 million and adjusted non-segment expenses were $21 million. At the Woodward level, R&D for the first quarter of 2023 was $29 million or 4.6% of sales, compared to $25 million or 4.7% of sales. SG&A for the first quarter of 2023 was $63 million, compared to $62 million.

The effective tax rate was 6.7% for the first quarter of 2023. For the first quarter of 2022, the effective tax rate was 19.7% and the adjusted effective tax rate was 20.6%. Looking at cash flows. Net cash provided by operating activities for the first quarter of fiscal 2023 was $5 million, compared to net cash provided by operating activities of $39 million. Capital expenditures were $24 million for the first quarter of 2023, compared to $13 million. Free cash flow was negative $19 million for the first quarter of fiscal 2023. The first quarter of fiscal 2022, free cash flow was $26 million and adjusted free cash flow was $27 million. The decrease in free cash flow was primarily related to the inventory increases, due to supply chain and labor disruption impacts; increased capital expenditures; and timing of tax payments.

Leverage was 2.3 times EBITDA at the end of the first quarter. During the first quarter of fiscal 2023 $37 million was returned to stockholders in the form of $11 million of dividends and $26 million of repurchased shares under our board authorized share repurchase program. Turning to our fiscal 2023 outlook. Woodward’s previously stated fiscal 2023 outlook remains unchanged. We anticipate total net sales for fiscal 2023 to be between $2.60 billion and $2.75 billion. Aerospace sales growth is expected to be between 14% and 19% and industrial sales growth is expected to be flat to up 5%. Aerospace segment earnings as a percent of segment sales are expected to increase by approximately 150 basis points to 200 basis points. Industrial segment earnings as a percent of segment sales are expected to be flat year-over-year.

The effective tax rate is expected to be approximately 19%. Free cash flow is expected to be between $200 million to $250 million. Capital expenditures are expected to be approximately $80 million. Earnings per share is expected to be between $3.15 and $3.60 based on approximately $61 million of fully diluted weighted average shares outstanding. Our fiscal 2023 outlook assumes improving operational and financial performance, while continuing to navigate a challenging industry-wide environment. The supply chain and labor disruptions are anticipated to begin to subside during the second half of the fiscal year. However, the timing of improvement is uncertain and results could negatively be impacted if so, supply chain and labor disruptions do not improve as expected.

Finally, a few reminders to assist you with your modeling. As a result of our strategic investments and mitigation actions, we anticipate the supply chain and labor disruptions will begin to subside in the second half the fiscal year. We expect the full-year price realization to be in the range of 5% of sales. EBIT for the full-year is expected to include approximately $60 million of annual variable incentive compensation costs, an increase of approximately $50 million over the prior year, $12 million of variable incentive compensation was recorded in the first quarter of fiscal 2023. We anticipate our interest expense will increase by approximately $10 million, primarily due to rising interest rates. As we reduce our past dues in the second half of the year, we expect to generate free cash flow in the same period.

This concludes our comments on the business and results for the first quarter of 2023. Operator, we are now ready to open the call to questions.

See also 25 Countries with the Lowest Corporate Tax Rates and 30 Largest Trading Partners of the US.

Q&A Session

Follow Woodward Inc. (NASDAQ:WWD)

Follow Woodward Inc. (NASDAQ:WWD)

Receive real-time insider trading and news alerts

Operator: Thank you. The question-and-answer session will begin at this time. Our first question comes from the line of Robert Spingarn with Melius Research. Your line is now open.

Robert Spingarn: Hey, good afternoon.

Chip Blankenship: Good afternoon, Rob.

Robert Spingarn: I’m not sure who wants to take this, but I — it’s about margins. And I just want to understand what deteriorated from last quarter to this quarter or what pressures got worse? I understand comp went up, but it would seem the other things would have been relieved by like you mentioned higher volumes and the fact that it’s — these margins are lower both quarter-over-quarter and year-over-year. Perhaps you can offer some clarity on that in that?

Mark Hartman: Yes. So let me take a stab at that and just for clarity, let’s first start with the sequential, because I think that Rob, that’s where your question started. If you actually look at sequentially, the volumes are actually down, which is what we had anticipated just based on the lower number of working days that we were talking about in the November call. And in addition to that we also had the variable compensation increase that we also discussed at the November call. And then the one other headwind on the earnings side was really on the industrial side of the business was the currency related impacts, which of course we can’t forecast what the currency rates are going to do and that’s primarily driven by the euro and just translating the euros to U.S. dollars. So sequentially that was really the drivers around the sequential earnings decline both in dollars and in rate.

Robert Spingarn: Without going through all the math, if you didn’t have the fewer working days in the currency, would at least on the aerospace side, would sequential revenues have been up just given that those businesses are recovering and ramping, so the normal seasonality, I would think shouldn’t apply?

Mark Hartman: Yes, I mean, we always have a little bit of normal seasonality in our fiscal Q1 quarter just based on it’s a lot of our customers year-end, they’re Q4. And so our Q1 is always a little lighter and some of it’s just how they’re managing their inventories and then the other is just the number of work days around the holidays. So this isn’t — our sequential decline in revenue is not related to demand at all. It is truly just a matter of output and how our customers are pulling product from us.

Robert Spingarn: Okay. And I assume it’s not inventory in the channel. That sounds like that’s not an issue.

Mark Hartman: That’s correct.

Robert Spingarn: Okay. And just tip for you just higher level you’ve talked about last quarter and touched on it this quarter about improving the business. Bringing more machining in-house and just solving problems. Does the business need more help looking at it today than you thought three months ago as you get more time to dig into it and see what’s really going on?