We recently compiled a list of the 10 Trending AI Stocks on Wall Street’s Radar. In this article, we are going to take a look at where Wolfspeed, Inc. (NYSE:WOLF) stands against the other AI stocks.

As leaders of some of the biggest companies, economists and world leaders congregated at the 2025 Davos Promenade in Switzerland, artificial intelligence is one topic that featured prominently. It did not come as a surprise, given the AI boom has propelled the market caps of some companies, with some becoming trillion-dollar empires.

This year’s WEF covered both the risks associated with rapidly evolving systems and the latest developments in artificial intelligence. The focus was on current developments with AI agents and artificial general intelligence, or AGI, which describes AI systems that are more intelligent than humans. One thing that came out clear is that a majority of company executives, 58%, expect generative AI solutions to be adopted at scale this year.

However, even as AI continues to dominate most spaces, the question remains whether companies and businesses have the infrastructure and skills to get the most out of the revolutionary technology. “From boosting operational efficiency to delivering insights and discovering new opportunities, AI has the power to redefine how businesses operate. Yet, for many organizations, this potential remains out of reach “because the road to AI adoption is strewn with challenges that often derail success,” said Paul Pallath, vice president of applied AI at technology consulting firm Search.

Businesses must overcome these obstacles and lay a strong foundation for long-term AI integration if AI is to provide genuine value, according to Pallath. Developing a data infrastructure to support AI initiatives is one of the most difficult tasks.

According to an EY survey of 500 senior business executives in the United States last year, 83% of participants stated that having a more robust data infrastructure would speed up their company’s adoption of AI. Two-thirds acknowledged that a lack of infrastructure is hampering their companies’ adoption of AI.

The new US administration under Donald Trump has found an answer to the infrastructure concern that some people believe has hampered growth in the sector. A $500 billion Stargate project involving major tech companies could help accelerate the country’s AI infrastructure development.

“Infrastructure in the United States is super important, AI is a little bit different from other kinds of software in that it requires massive amounts of infrastructure, power, computer chips, data centers, and we need to build that here and we need to be able to have the best AI infrastructure in the world to be able to lead with the technology and the capabilities, “said OpenAI’s Sam Altman.

The Stargate project intends to immediately deploy the first $100 billion, beginning with a data centre in Abilene, Texas, that is 500,000 square feet in size. There are plans to build nine more facilities, with the possibility of expanding to twenty.

The $500 billion Stargate project comes when tech giants and startups are racing to gain a head start and strengthen their product portfolio around artificial intelligence. Funding to AI-related companies reached over $100 billion in 2024, up more than 80% from $55.6 billion in 2023. Amid the massive AI investment, investment opportunities are also cropping up in the equity markets.

Our Methodology

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

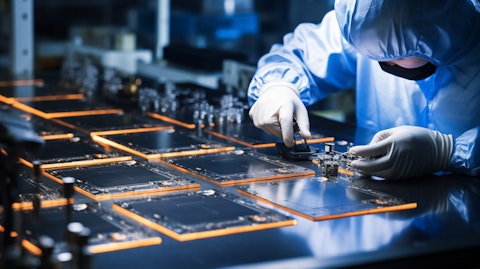

A worker assembling metal oxide semiconductor field effect transistors (MOSFETs) on a conveyer belt.

Wolfspeed, Inc. (NYSE:WOLF)

Number of Hedge Fund Holders: 26

Wolfspeed, Inc. (NYSE:WOLF) operates as a band gap semiconductor company focused on silicon carbide and gallium nitride (GaN) technologies. It offers silicon carbide and GaN materials, including silicon carbide bare wafers and GaN epitaxial layers on silicon carbide wafers. On January 22nd, Christopher Rolland of Susquehanna reiterated a Hold rating on the stock.

While Wolfspeed, Inc. (NYSE:WOLF) has been under pressure, its long-term prospects remain solid as the AI boom fuels demand for semiconductors. As a leading provider of silicon carbide products used in power applications, the company can benefit from the growing demand for components that enhance energy efficiency in data centres.

Last year, Wolfspeed, Inc. (NYSE:WOLF) secured $2.5 billion in government grants and private investments to expand its silicon carbide production capabilities in the US. The US Department of Commerce committed $750 million in funding to help strengthen the company’s semiconductor capabilities to reduce reliance on foreign supplies. A $750 million funding from private investors affirmed growing optimism about the company’s potential amid increasing demand for silicon carbide technology.

Overall WOLF ranks 10th on our list of trending AI stocks on Wall Street’s radar. While we acknowledge the potential of WOLF as an investment, our conviction lies in the belief that some deeply undervalued AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for a deeply undervalued AI stock that is more promising than WOLF but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. This article was originally published at Insider Monkey.