Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of William Lyon Homes (NYSE:WLH).

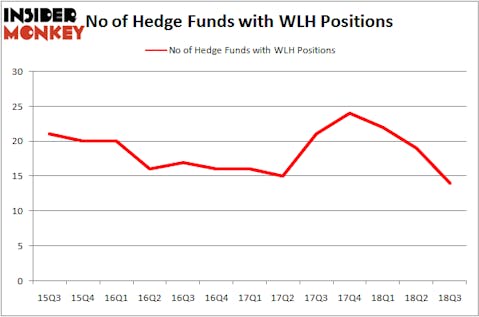

Is William Lyon Homes (NYSE:WLH) the right pick for your portfolio? Prominent investors are reducing their bets on the stock. The number of bullish hedge fund positions fell by 5 lately. Our calculations also showed that WLH isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action regarding William Lyon Homes (NYSE:WLH).

How have hedgies been trading William Lyon Homes (NYSE:WLH)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -26% from the second quarter of 2018. On the other hand, there were a total of 24 hedge funds with a bullish position in WLH at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, GMT Capital, managed by Thomas E. Claugus, holds the biggest position in William Lyon Homes (NYSE:WLH). GMT Capital has a $55.4 million position in the stock, comprising 1.4% of its 13F portfolio. On GMT Capital’s heels is Israel Englander of Millennium Management, with a $24.3 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions comprise John Khoury’s Long Pond Capital, Tom Brown’s Second Curve Capital and Joe Huber’s Huber Capital Management.

Due to the fact that William Lyon Homes (NYSE:WLH) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of funds who sold off their full holdings by the end of the third quarter. Intriguingly, Michael Barnes and Arif Inayatullah’s Tricadia Capital Management sold off the largest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $14.8 million in stock. Peter Algert and Kevin Coldiron’s fund, Algert Coldiron Investors, also sold off its stock, about $2.7 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as William Lyon Homes (NYSE:WLH) but similarly valued. We will take a look at EP Energy Corp (NYSE:EPE), Vericel Corp (NASDAQ:VCEL), DryShips Inc. (NASDAQ:DRYS), and Earthstone Energy, Inc. (NYSE:ESTE). This group of stocks’ market caps match WLH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPE | 8 | 14662 | -1 |

| VCEL | 20 | 153385 | 0 |

| DRYS | 2 | 303 | -2 |

| ESTE | 5 | 7231 | 0 |

| Average | 8.75 | 43895 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $149 million in WLH’s case. Vericel Corp (NASDAQ:VCEL) is the most popular stock in this table. On the other hand DryShips Inc. (NASDAQ:DRYS) is the least popular one with only 2 bullish hedge fund positions. William Lyon Homes (NYSE:WLH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard VCEL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.