Insider Monkey’s data of 659 funds which filed 13Fs for the June quarter, and whose portfolios contained at least 5 long positions in companies valued at $1 billion, reveals some interesting statistics. Foremost was the fact that an impressive 95% of them delivered positive stock returns with those long positions during the third quarter based on our methodology. In comparison, S&P 500 ETFs returned just 3.3% during the quarter, so that high a percentage of funds posting gains is a noteworthy feat. However, what we don’t see in 13F filings are hedge funds’ holdings that don’t necessarily do as well: the short-side of their portfolios, as well as their low-yield debt positions. Couple that with demanding fees, and you can see why hedge funds consistently underperform the market net of fees, despite being quality stock pickers. That’s why at Insider Monkey, we analyze only the top stock picks of the top hedge funds, to cut through the fees and underperformance. In this article, we’ll take a look at the performance of Kora Management and four of its top stock picks, which are 58.com Inc (ADR) (NYSE:WUBA), Mercadolibre Inc (NASDAQ:MELI), Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), and Liberty Global PLC LiLAC Class A (NASDAQ:LILA).

Kora Management is a Brooklyn, New York-based investment fund managed by Nitin Saigal. Kora’s equity portfolio is worth $127.77 million. The fund returned 12.42% in the third quarter from 7 of its long holdings in companies which have a market cap of at least $1 billion. This fund, which is one of the newest additions to our database and invests primarily in Chinese stocks, caught our attention recently, as its stock picks returned 12.42% when looking at its 7 long positions in companies having a market cap of at least $1 billion (we filter out micro-cap stocks as they are overly volatile). We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market like Kora Management’s did in Q3, so let’s have a look at those aforementioned picks and see how they’ve performed.

Kora Management upped its stake in 58.com Inc (ADR) (NYSE:WUBA) in the second quarter, having ended the period with 635,000 shares of the company in its portfolio. The net worth of these shares was over $29.14 million. The stock returned 3.9% during the third quarter. 58.com Inc (ADR) (NYSE:WUBA) was in 29 hedge funds’ portfolios at the end of June, up from 27 hedge funds in our database with WUBA holdings at the end of the previous quarter. Among these funds, Hillhouse Capital Management held the most valuable stake in 58.com Inc (ADR) (NYSE:WUBA), which was worth $170.6 million at the end of the second quarter. On the second spot was OZ Management which amassed $166.5 million worth of shares. Moreover, Viking Global, Emerging Sovereign Group, and Serenity Capital were also bullish on 58.com Inc (ADR) (NYSE:WUBA).

Kora Management added Mercadolibre Inc (NASDAQ:MELI) as a new position to its portfolio during Q2 by buying 165,000 shares of the company valued at about $23.21 million at the end of the quarter. The stock returned a hefty 31.6% during the third quarter, making this move an immediate success for the fund. At Q2’s end, 21 hedge funds tracked by Insider Monkey were bullish on this stock, unchanged quarter-over-quarter. The largest stake in Mercadolibre Inc (NASDAQ:MELI) was held by Generation Investment Management, which reported holding $152.5 million worth of its stock at the end of June. It was followed by Balyasny Asset Management with a $113.8 million position. Other investors bullish on the company included Jericho Capital Asset Management and Orbis Investment Management.

Follow Mercadolibre Inc (NASDAQ:MELI)

Follow Mercadolibre Inc (NASDAQ:MELI)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

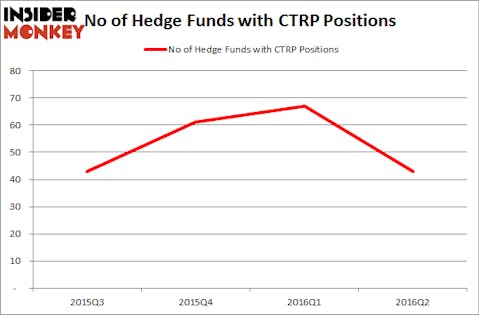

Kora Management unloaded 13% of the Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP) shares in its portfolio in the quarter ended June 30. Heading into the third quarter, the fund had a total of 558,480 shares of the company, which had a total value of $23.01 million. The stake performed in-line with the overall returns of the fund’s aforementioned seven picks, as the stock delivered some 13% gains in the September quarter. Kora was one of the few hedge funds that bought into CTRP in Q3, as it was in 43 hedge funds’ portfolios at the end of June, down from 67 at the end of the previous quarter. Among the funds that were still bullish, Fisher Asset Management held the most valuable stake in Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), which was worth $410.1 million at the end of the second quarter. On the second spot was Hillhouse Capital Management which amassed $333.4 million worth of shares. Moreover, Viking Global, Tourbillon Capital Partners, and OZ Management were also bullish on Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP).

Follow Trip.com Group Limited (NASDAQ:TCOM)

Follow Trip.com Group Limited (NASDAQ:TCOM)

Receive real-time insider trading and news alerts

There were 538,175 Liberty Global PLC LiLAC Class A (NASDAQ:LILA) shares in Kora Management’s portfolio at the end of June, which shows that the fund sold 35% of its stake in the company during the second quarter, leaving a $17.36 million stake in the company. The stock disappointed Kora Management and other investors with a loss of 14.5% during the third quarter. At the end of the second quarter, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a 113% jump from the previous quarter. The largest stake in Liberty Global PLC LiLAC Class A (NASDAQ:LILA) was held by Berkshire Hathaway, which reported holding $87.6 million worth of stock at the end of June. It was followed by Coatue Management with a $25.7 million position. Other investors bullish on the company included Marianas Fund Management and Glenview Capital.

Follow Liberty Global Ltd.

Follow Liberty Global Ltd.

Receive real-time insider trading and news alerts

Disclosure: None