Immersion Capital is a London-based hedge fund founded by Michael Sidhom, who previously oversaw a long-short stock fund at Ziff Brothers. During the third quarter, Immersion Capital’s portfolio declined to $238.74 million from $259.02 million. In the third quarter, the fund’s 13F portfolio returned 13.98% based on its five long positions in companies worth over $1 billion, based on the size of these holdings at the end of June.

Our approach reveals interesting facts about hedge funds’ stock picking skills. For instance, there were 659 hedge funds in our database that held long positions in at least five companies valued at over $1.0 billion. These hedge funds’ long portfolio managed to deliver an average return of 8.3% during the third quarter, whereas S&P 500 ETFs returned only 3.3%. We should note that hedge fund investors didn’t see average gains of 8.3% in their statements for two reasons. First, most hedge funds are hedged. This means they make 8% on the long side of their portfolio but they lose money on the short side of their portfolio. Their net returns also shrink after taking into account their cash or debt positions that don’t usually return much in this environment. Second, we don’t like this and believe that hedge fund fees are excessive, most hedge funds charge an arm and a leg for their services. Net of hedging and fees, it isn’t surprising to see that hedge fund investors experience lower returns than index fund investors. If investors don’t want the downside protection that comes with investing in hedge funds and want to beat the market returns, they can consider investing in the individual stock picks successful hedge fund managers.

Having said that, let’s take a closer look at some of Immersion’s top holdings and how they performed last quarter.

3d Pictures/Shutterstock.com

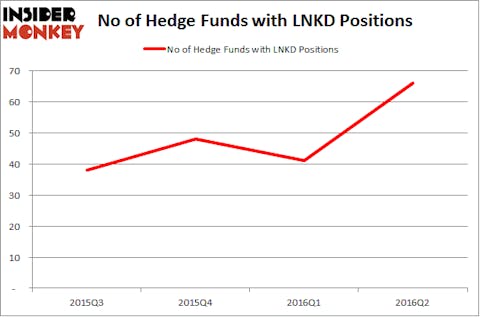

As LinkedIn Corp (NYSE:LNKD)’s stock inched up by 1% during the third quarter, Immersion closed its position in the company, which contained 395,000 shares worth $74.75 million at the end of June. At the end of June, a total of 66 of the hedge funds tracked by Insider Monkey were long this stock, a change of 61% from the first quarter of 2016. The largest stake in LinkedIn Corp (NYSE:LNKD) was held by SRS Investment Management, which reported holding $504.5 million worth of stock at the end of June. It was followed by Pentwater Capital Management with a $492.3 million position. Other investors bullish on the company included Arrowgrass Capital Partners, Farallon Capital, and D E Shaw.

Follow Linkedin Corp (NYSE:LNKD)

Follow Linkedin Corp (NYSE:LNKD)

Receive real-time insider trading and news alerts

Immersion Capital had over 1.97 million shares of GrubHub Inc (NYSE:GRUB) heading into the third quarter and left the position unchanged in the following three months. However, amid a 38.4% gain registered by the stock, the value of the holding surged to $84.74 million from $61.25 million. Heading into the third quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 9% over the quarter. The largest stake in GrubHub Inc (NYSE:GRUB) was held by Pelham Capital, which reported holding $179.1 million worth of stock as of the end of June. It was followed by PAR Capital Management with a $169.5 million position. Other investors bullish on the company included Luxor Capital Group, Steadfast Capital Management, and Joho Capital.

Follow Grubhub Inc. (NASDAQ:GRUB)

Follow Grubhub Inc. (NASDAQ:GRUB)

Receive real-time insider trading and news alerts

Amazon.com, Inc. (NASDAQ:AMZN)‘s stock returned 17% in the third quarter, as Immersion left its stake unchanged at 78,256 shares, whose value went up to $65.53 million from $56.00 million. Amazon.com, Inc. (NASDAQ:AMZN) was included in the equity portfolios of 145 funds tracked by us at the end of June, up from 133 funds at the end of March. Among these funds, Andreas Halvorsen’s Viking Global had the biggest position in Amazon.com, Inc. (NASDAQ:AMZN), worth close to $2.35 billion at the end of June. Sitting at the No. 2 spot was Ken Fisher’s Fisher Asset Management, with a $1.50 billion position. Other peers that were bullish included Alex Snow’s Lansdowne Partners, Boykin Curry’s Eagle Capital Management, and Stephen Mandel’s Lone Pine Capital.

Follow Amazon Com Inc (NASDAQ:AMZN)

Follow Amazon Com Inc (NASDAQ:AMZN)

Receive real-time insider trading and news alerts

After having initiated a stake in Berkshire Hathaway Inc. (NYSE:BRK-B) during the second quarter, Immersion sold out all of its 231,081 shares between July and September, as the stock remained close to flat. At the end of the second quarter, a total of 78 investors tracked by Insider Monkey were bullish on this stock, a change of 10% from one quarter earlier. Among these funds, Bill & Melinda Gates Foundation Trust held the most valuable stake in Berkshire Hathaway Inc. (NYSE:BRK.B), which was worth $9.32 billion at the end of the second quarter. On the second spot was Eagle Capital Management which amassed $1.91 billion worth of shares. Moreover, Gardner Russo & Gardner, Fisher Asset Management, and International Value Advisers were also bullish on Berkshire Hathaway Inc. (NYSE:BRK.B).

Follow Berkshire Hathaway Inc (NYSE:BRK.A)

Follow Berkshire Hathaway Inc (NYSE:BRK.A)

Receive real-time insider trading and news alerts

Disclosure: none