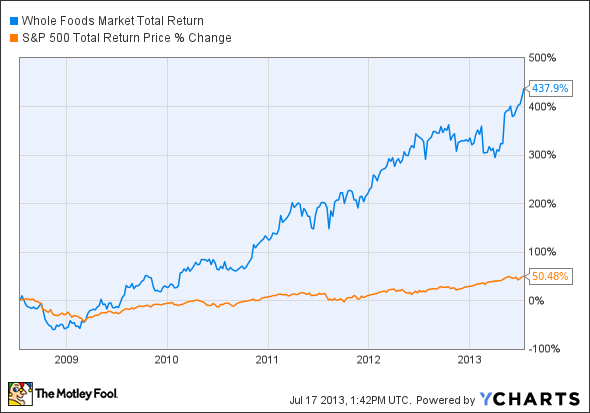

Over the past five years organic grocer, Whole Foods Market, Inc. (NASDAQ:WFM) grew trailing revenue and free cash flow 57% and 1600% respectively (see charts below). This translated into a market beating total return of 438%. You can expect this trend to continue due to the three reasons listed below.

WFM Revenue TTM data by YCharts

WFM Revenue TTM data by YCharts

WFM Total Return Price data by YCharts

WFM Total Return Price data by YCharts

People want to eat healthier

Whole Foods Market, Inc. (NASDAQ:WFM) in its “conscious” capitalist fervor not only wants to capitalize on this trend but improve the health of the world in general. It also believes in keeping its own house in order first before preaching to the world. Employees get rewarded for lowering health care costs by encouraging a healthier lifestyle. Employee and stakeholder health ranks so high in importance with Whole Foods Market, Inc. (NASDAQ:WFM) that it decided to make that a core company value.

Beverage giant The Coca-Cola Company (NYSE:KO) experienced a 6% gain in its global still beverage volume versus just even in its more traditional sparkling beverage unit during its most recent quarter, serving as further evidence that people want to move away from the sugary and fattening soda drinks. Regulators seeing the negative effects want to regulate portion sizes of its drinks served in restaurants. The future prosperity of this company will also depend upon its ability to serve up healthier beverages such as bottled water and juice.

Better treatment of employees

Litigation from a Pennsylvania employee of a McDonald’s Corporation (NYSE:MCD) franchisee surrounding dubious debit card pay methods demonstrates that not everyone affiliated with McDonald’s holds the interest of lower level employees close to heart. It’s worth noting that these employees weren’t employed by McDonald’s Corporation (NYSE:MCD) directly; however, McDonald’s needs to know that happy stakeholders will take better care of its brand.

By contrast, Whole Foods Market, Inc. (NASDAQ:WFM) believes the bottom line gets tied to the economic interests of all stakeholders including employees. The company ranked #32 on Fortune’s list of “100 Best Companies to Work for in America” according to its 2012 annual report. Employees rank Whole Foods as 3.5 out of 5 translating into a “satisfied” rating versus 3.1 at McDonald’s Corporation (NYSE:MCD) or an “ok” rating at glassdoor.com.

Still in a growth phase

Whole Foods Market, Inc. (NASDAQ:WFM) still resides in a growth phase with market saturation nowhere in sight. As of the most recent quarter the company still only operated 349 stores with some states such as West Virginia having no Whole Foods’ at all. Whole Foods’ comparable store sales growth clocked in at an impressive 7% during the last quarter. In addition, its overall sales increased 13%.