Hedge funds have been underperforming the market for years in aggregate, as many in the media are only all too happy to pound home. But if analyze in detail, and consider the correct data points, we come to know that the reality is different. When we look at the third-quarter returns of the hedge funds in our database which had at least 5 long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, a full 5.0 percentage points clear of S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions.

We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market, and will share four such picks today, courtesy of the 13F portfolio of Tekne Capital Management. Tekne Capital is a New York-based hedge fund founded in 2012 by Beeneet Kothari. Tekne Capital’s public equity portfolio was valued at $369.29 million on June 30 and consisted of 17 long positions in companies with a market cap of at least $1 billion. Those picks returned a weighted average of 12.7% in the third quarter. In this article, we’ll look at Tekne Capital’s most important bets moving into the third quarter, including Microsoft Corporation (NASDAQ:MSFT), Intel Corporation (NASDAQ:INTC), Baidu.com, Inc. (ADR) (NASDAQ:BIDU) and Cogent Communications Group, Inc. (NASDAQ:CCOI).

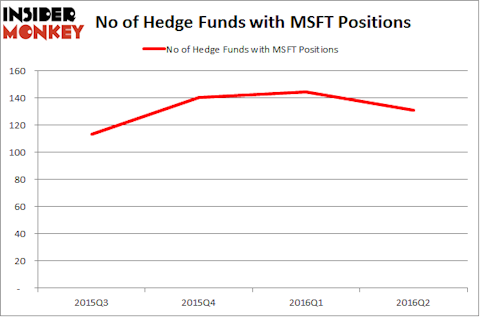

Tekne Capital Management had 877,100 shares of Microsoft Corporation (NASDAQ:MSFT) in its portfolio at the end of the second quarter. The total worth of the position was over $44.88 million on June 30. Shares of the tech giant returned 13.3% during the third quarter. At the end of the second quarter, a total of 131 of the hedge funds tracked by Insider Monkey were long this stock, down by 9% from the previous quarter. Nonetheless, it remained one of the most popular stocks among the hedge funds in our system. The largest stake in Microsoft Corporation (NASDAQ:MSFT) among them was held by ValueAct Capital, which reported holding $290 billion worth of stock as of the end of June. It was followed by Eagle Capital Management with a $1.56 billion position. Other investors bullish on the company included First Eagle Investment Management, Fisher Asset Management, and Lone Pine Capital.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

There were over 1.1 million shares of Intel Corporation (NASDAQ:INTC) in Tekne Capital Management’s portfolio at the end of June. The aggregate value of this stake was about $35.37 million at that time. Intel’s stock delivered 16% returns during the third quarter. At the end of the second quarter, a total of 57 of the hedge funds tracked by Insider Monkey were long this stock, a 6% increase from one quarter earlier. Ken Fisher’s Fisher Asset Management has the most valuable position in Intel Corporation (NASDAQ:INTC), worth close to $682.7 million, corresponding to 1.3% of its total 13F portfolio. The second largest stake is held by Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $363.5 million position. Remaining peers that are bullish contain Richard S. Pzena’s Pzena Investment Management, Phill Gross and Robert Atchinson’s Adage Capital Management, and Cliff Asness’ AQR Capital Management.

Follow Intel Corp (NASDAQ:INTC)

Follow Intel Corp (NASDAQ:INTC)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.