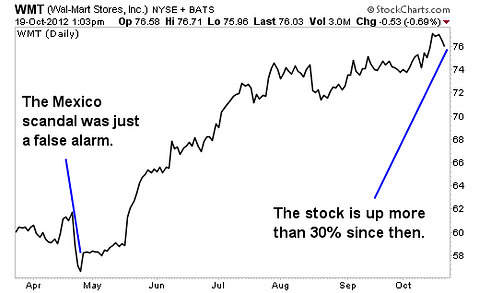

That was an unnecessary exercise. The scandal was soon over and value investors spotted an opening, pushing shares up ever higher during the course of the summer. Since the scandal broke, Wal-Mart has added more than $50 billion to its already considerable market value.

That’s the power of owning one of the World’s Greatest Businesses (we here at StreetAuthority callthem “WGBs” for short). They’re able to weather practically any kind of storm and yet still somehow find a way to continue rewarding shareholders in the process.

Yet here’s the remarkable thing: Even after impressive gains, this stock is still undervalued according to one key financial metric. Thanks to a very tight control over capital spending — just enough to keep the global expansion humming — Wal-Mart is morphing into one of the greatest free cash flow stories of our generation.

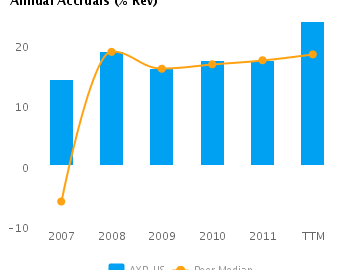

Roughly two years ago, I made a case that shares of Wal-Mart were undervalued on the context of their free cash flow yield. At the time, Wal-Mart sported a 5.6% free cash flow yield, which is even higher than the corporatebond yields that you will find on blue chips like this one. In effect, Wal-Mart’s stocks were more attractively valued than its bonds.

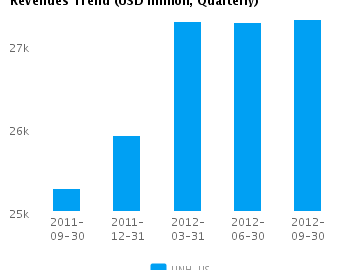

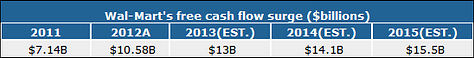

Well, a few years later, we now have a clearer sense of what Wal-Mart’s free cash flow will look like in fiscal 2013, 2014 and 2015. And it’s quite impressive. The company held its annual meeting with Wall Street analysts earlier this month, and management’s blueprints helped clarify these analysts’ free cash flow projections. Here is the average free cash flow projection for the next few years.

In fiscal (January) 2011, Wal-Mart generated roughly $7 billion in free cash flow. In the current fiscal yearthat ends this coming January, that figure is expected to reach $13 billion. That’s a stunning jump in a bad economy. The key catalyst for rising free cash flow has, counter-intuitively, been the result of price-cutting. Wal-Mart’s move to “every day low prices” (EDLP as the company calls it) has again sharpened the company’s perceived value proposition among customers, which is leading to steady same-store sales gains.

Now, back to that free cash flow yield. This giant retailer is now worth $257 billion and if you use fiscal 2014 free cash flow as a basis, then shares are sporting a free cash flow yield 5.4% ($11.4B / $257B). That’s still a comfortably higher yield than Wal-Mart’s bonds, which generally offer a yield-to-maturity of just below 4%.

The key takeaway: Right now you can own shares of one of the World’s Greatest Businesses at a more attractive price than its bonds. This stock is likely to keep attracting value investors until the stock price rises up to the point where the free cash flow yield slips to 4%. This scenario implies a market value of $350 billion, which suggests 36% upside from here for patient investors.

Yet my investment thesis isn’t around how much upside this stock has. Instead, it’s how much downside protection it has. If the market gets choppy and investors start selling stocks, then they’re likely to stand by Wal-Mart, thanks to the retailer’s prodigious free cash flow.

Risks to Consider: Part of Wal-Mart’s renewed vigor is due to a slightly more optimistic consumer. Yet just a few years ago, Wal-Mart felt the pain of a distressed consumer just as much as other retailers. So if the U.S. economy slumps badly in 2013, then it will be hard for this stock to move any higher.

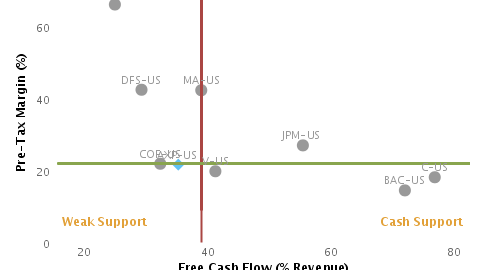

Action to Take –> You can run this free cash flow exercise with any investment. As a general rule of thumb, free cash flow yields above 5% represent solid value, and free cash flow yields above 8% represent stunning value. What kinds of companies are we talking about? Well, insurers such as AFLAC Incorporated (NYSE:AFL), Metlife Inc (NYSE:MET) and Prudential Financial Inc (NYSE:PRU) make the grade, as do Southwest Airlines Co. (NYSE:LUV) and SunTrust Banks, Inc. (NYSE:STI).

This article was originally written by David Sterman, and posted on StreetAuthority.