Justice Department Pressuring Och-Ziff for Guilty Plea

Shares of Och-Ziff Capital Management Group LLC (NYSE:OZM) have lost more than 21% today after the Wall Street Journal reported on Monday that federal authorities are in discussions with the firm over a possible guilty plea related to a lengthy international bribery investigation. The Justice Department is looking into whether the New York-based firm knowingly bribed government officials in Libya and other African countries. The authorities are also seeking civil sanctions of approximately $400 million from Och-Ziff Capital. According to the source, Och-Ziff’s lawyers argue that the alleged illegal behavior and embezzlement was not widely known at the firm and that the activities in question were worth less than $100 million in profit.

Overall, 15 hedge funds out of those tracked by us held positions in Och-Ziff Capital Management Group LLC (NYSE:OZM). The total value of these investments is approximately $7.4 million. Crispin Odey’s Odey Asset Management Group owns approximately 4 million shares of the company.

Record Quarterly Results Not Impressing Investors

Bank Of The Ozarks Inc (NASDAQ:OZRK)’s stock has lost more than 2% today after the release of the company’s first quarter earnings report. The holding company earned a record $51.7 million in the first quarter, a 30% jump from the same quarter a year earlier, while assets jumped to $11.4 billion, up by 38% year-over-year.

“This excellent growth was achieved while adhering to our very conservative credit principles,” George Gleason, the bank’s CEO, said in a press release.

15 funds in our system held stakes in Bank Of The Ozarks Inc (NASDAQ:OZRK) with a total value of approximately $198.1 million. Among these hedge funds, John Brennan’s Sirios Capital Management had one of the largest stakes, amounting to more than 1.00 million shares of the company.

Follow Bank Ozk (NASDAQ:OZK)

Follow Bank Ozk (NASDAQ:OZK)

Receive real-time insider trading and news alerts

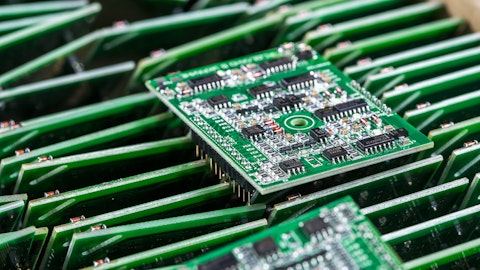

Sliding PC Sales Dent Micron

Micron Technology, Inc. (NASDAQ:MU)‘s stock has declined by more than 1% as the company continues to face high competition from market giants like Samsung. Samsung has reduced the price of its DRAM products, which has dented the profit margins of Micron. Micron reported an adjusted net loss for the second quarter of fiscal year 2016 on March 30, which led analysts to point to DRAM competition along with other factors such as the decline in the PC market and plunging mobile sector growth. It was also revealed today by Gartner that PC shipments fell by about 10% year-over-year in the first quarter. Shares of Micron are currently trading 64.91% below their 52-week high.

64 hedge funds out of those tracked by Insider Monkey held positions in Micron Technology, Inc. (NASDAQ:MU) at the end of 2015. The total value of these investments stood at approximately $1.32 billion. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital owns more than 16.00 million shares of the company as of the end of December.

Follow Micron Technology Inc (NASDAQ:MU)

Follow Micron Technology Inc (NASDAQ:MU)

Receive real-time insider trading and news alerts

Disclosure: None