In this article we will take a look at the some of notable stocks falling today. You can skip our detailed analysis of these stocks and go to read Why These 5 Stocks Fell on Monday.

At the beginning of the trading week, all three major indexes are down. The Dow has fallen 1%, the S&P 500 is down around 1.5%, and the NASDAQ is down 2.2%. Among the stocks that are also lower today include NVIDIA Corporation (NASDAQ:NVDA), Advanced Micro Devices, Inc. (NASDAQ:AMD), Facebook, Inc. (NASDAQ:FB), Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG), and Amazon.com, Inc. (NASDAQ:AMZN). Let’s find out why each stock is lower and how elite funds are positioned among them.

Why do we care about hedge fund activity? Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 86 percentage points since March 2017. Between March 2017 and July 2021 our monthly newsletter’s stock picks returned 186.1%, vs. 100.1% for the SPY. Our stock picks outperformed the market by 86 percentage points (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

Pixabay/Public Domain

10. Facebook, Inc. (NASDAQ:FB) has fallen over 5.6% due to a negative Wall Street Journal series, “The Facebook Files”. According to one way to read the series of articles, Facebook has a two tiered justice system and the tech giant knew Instagram was worsening body image issues among girls. The series also indicates that Facebook may have a bigger vaccine misinformation problem than what the company has indicated. Facebook, Inc. (NASDAQ:FB) may be down due to the expected rise in Treasury yields as well. Billionaire Mark Zuckerberg is long substantial shares in Facebook, Inc. (NASDAQ:FB).

9. Apple Inc. (NASDAQ:AAPL) shares have fallen 2.8% due to the weakness in Facebook and the broader market weakness. If a company like Facebook is worth less, a company like Apple Inc. (NASDAQ:AAPL) is also worth less to some investors based on relative valuation. Warren Buffett’s Berkshire Hathaway was long over 887.1 million shares of Apple Inc. (NASDAQ:AAPL) at the end of June.

8. Microsoft Corporation (NASDAQ:MSFT) has fallen around 2.4% on Monday due to the decline in big tech names. Given that Microsoft Corporation (NASDAQ:MSFT) shares have rallied almost 30% year to date, some investors may also be taking some profits. Microsoft Corporation (NASDAQ:MSFT) was the third most widely held ‘smart money’ stock at the end of Q2 according to our database of 873 elite funds.

7. Alphabet Inc. (NASDAQ:GOOG) is down around 2.5% due to the Facebook weakness and the broader market weakness. Although Facebook facing more headwinds could help Alphabet in some ways as it could mean less future competition in some areas, Alphabet Inc. (NASDAQ:GOOG) is also worth less to some investors if Facebook is worth less based on relative valuation. Alphabet Inc. (NASDAQ:GOOG) was among the top five most widely held ‘smart money’ stocks at the end of Q2 according to our database of around 873 elite funds.

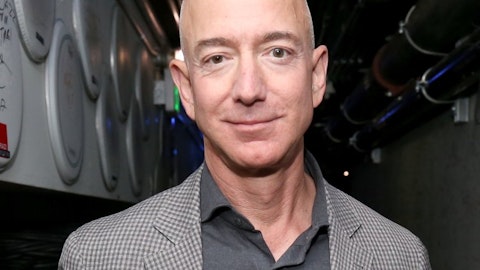

6. Amazon.com, Inc. (NASDAQ:AMZN) is down 2.7% due to the big tech weakness and the expected rise in Treasury yields in the future. If Treasury yields increase, some investors could allocate more to Treasuries and less to big tech names such as Amazon.com, Inc. (NASDAQ:AMZN). Amazon.com, Inc. (NASDAQ:AMZN) was the most widely held smart money stock in our database at the end of Q2.

Like Facebook, Inc. (NASDAQ:FB), Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG), and Amazon.com, Inc. (NASDAQ:AMZN), NVIDIA Corporation (NASDAQ:NVDA) and Advanced Micro Devices, Inc. (NASDAQ:AMD) are also lower.

Click to continue reading and see Why These 5 Stocks Fell on Monday.

Suggested articles

Is Facebook (FB) A Smart Long-Term Buy?

Were Hedge Funds Right About Facebook Inc (FB)?

Were Hedge Funds Right About Amazon.com, Inc. (AMZN)?

Disclosure: None. Why These 10 Stocks Fell on Monday is originally published on Insider Monkey.