We recently published a list of 10 Best Clothing Stocks To Invest In Now. In this article, we are going to take a look at where The Gap, Inc. (NYSE:GAP) stands against the other best clothing stocks to invest in now.

Trump’s Proposed Tariffs: How Will They Affect Retailers?

While the inflation figures have come down a little, they are still sticky. More consumers, even at higher income levels, are gravitating towards discounters. The reason is simple: prices are still higher than what they used to be. On November 26, Dana Telsey of Telsey Advisory Group appeared on CNBC to discuss the potential implications of Trump’s proposed tariffs on consumer prices and margin challenges for retailers.

She said that if the tariffs do come to fruition, the apparel industry will certainly be impacted. It is estimated that up to $80 billion in consumer spending could be impacted, which would require a double-digit increase in prices for some of the apparel goods.

Trends in the Holiday Shopping Season

Retail stocks are taking center stage with holiday shopping kicking off. However, the consumer spending front presents a dichotomy. While one side shows healthy consumer spending, the other side presents stretched credit and consumer spending patterns showing an increasing inclination for discounts.

On November 28, John San Marco, Neuberger Berman portfolio manager, joined CNBC’s ‘Closing Bell Overtime’ to discuss the recent trends in the retail sector. Listing how this season is different from the past few years, he said that real wages have been positive for a while now, with significant cohorts of consumers holding balance sheets in pretty good shape, particularly homeowners. There hasn’t been a discretionary comeback yet. Without any significant market disruption, he believes the season will see the consumer behave in a healthier fashion moving forward.

A significant consideration in the current holiday shopping season is whether retail investors should be concerned about a dynamic where some retailers bring inventory into the US ahead of the tariffs. Since this holiday season is expected to be relatively shorter, the retailers might have to discount their inventory to avoid having their warehouses too full.

Marco said that tactically figuring out the inventory inflow is complicated, made much more challenging by the volatility surrounding the election and the weather conditions. Some retailers may be able to capitalize on the situation’s unpredictability and buy stuff opportunistically. However, Marco is of the opinion that a premium on high-quality retailers that offer an unbeatable consumer value proposition is paramount.

Should Investors be Feeling Bullish About the Holiday Shopping Season?

On November 28, ‘Fast Money’ traders appeared on CNBC to discuss what to expect from retailers with the holiday season kicking off. Viewing the American retail sector through the lens of stocks soaring at all-time highs, the 2024 holiday season looks pretty positive.

However, there is another side to that coin as well, as some stocks are sinking to lows. Credit card debt is approaching $1.2 trillion, and delinquency rates are at a 13-year high. The situation thus presents a bifurcated retail environment. Despite this bleak side of the coin, people are feeling great about things at the present.

With a number of major events now in the past, people believe they are getting closure. The overall environment is simmering down, which is a tailwind for confidence in the analysts’ opinion. Agreeing with these points, Karen Finerman, Co-founder and CEO of Metropolitan Capital, said that markets and people both hate uncertainty. She believes that the market has risen a lot, and several other positive factors are making people feel better. Most retailers are positioned well on an inventory standpoint and can get good margins. She is thus comfortable with the current retail setup.

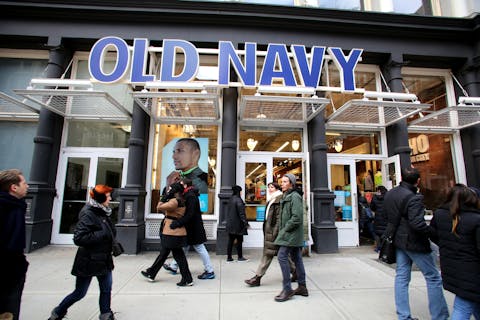

Northfoto / Shutterstock.com

Our Methodology

For this article, we used the Finviz stock screener to identify around 15 clothing stocks and narrowed our list to 10 stocks with the most positive analyst upside from current levels. We also added the number of hedge fund holders for each stock, as of Q3 2024. The stocks are arranged in ascending order of their upside potential as of November 29, 2024.

At Insider Monkey, we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

The Gap, Inc. (NYSE:GAP)

Analyst Upside: 21.80%

Number of Hedge Fund Holders: 39

The Gap, Inc. is a specialty apparel company in the US that offers apparel, accessories, and personal care products for women, men, and children. The company’s brand portfolio includes Old Navy, Gap, Banana Republic, and Athleta brands. The Gap brand offers adult apparel and accessories, Gap Maternity, GapKids, babyGap, GapBody, and GapFit collections. Banana Republic is a lifestyle retailer that offers womenswear, menswear, and home designs.

The company’s net sales grew for the fourth consecutive quarter in fiscal Q3 2024. It also attained an expanded gross margin and delivered its highest Q3 operating margin in seven years. The company also gained market share for the seventh consecutive quarter. This growth is attributed to the execution of The Gap, Inc.’s strategic priorities, notably its discipline and rigor in implementing its brand reinvigoration playbook.

The Gap, Inc.’s campaigns and collaborations are attracting a new generation to the company while simultaneously reinforcing the brand for its existing customers. It executed the Get Loose campaign in fiscal Q3 2024, which featured Troye Sivan and was rooted in Denim. The campaign was amplified by the relevant storytelling around the Loose Trend, earning the company a share increase in Denim with positive customer feedback on both the communications and the product. It takes the sixth spot on our list of the 10 best clothing stocks to invest in now.

Overall, GAP ranks 6th on our list of best clothing stocks to invest in now. While we acknowledge the potential of clothing stocks, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than GAP but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.