ShawSpring Partners, a value-focused investment firm, published its fourth-quarter 2020 Investor Letter – a copy of which can be downloaded here. The hedge fund currently holds eight multinational businesses that offer products and services around the globe. You can view the fund’s top 10 holdings to have a peek at their top bets for 2021.

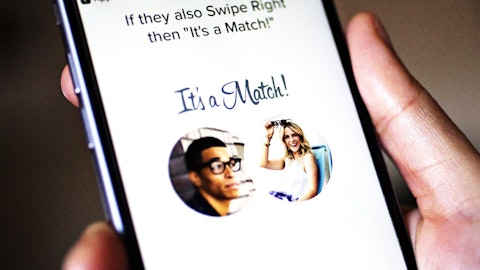

ShawSpring Partners, in their Q4 2020 Investor Letter said that they are optimistic for the future of Match Group, Inc. (NASDAQ: MTCH) and that they continue to be excited about their investment in the company. Match Group, Inc. is an online dating internet and technology company that currently has a $37.5 billion market cap. For the past 3 months, MTCH delivered a 17.21% return and settled at $141 per share at the closing of January 22nd.

Here is what ShawSpring Partners has to say about MTCH in their investor letter:

“Our investment in Match Group commenced when we purchased our stake in IAC. At that time, IAC owned 84% of Match Group, with Match Group accounting for most of IAC’s net asset value. We continue to be excited about our investment in Match Group. Tinder’s outlook remains strong, especially as it further penetrates more nascent markets, like Southeast Asia and India, where category penetration is low. Beyond Tinder, Match Group’s other brands are becoming material growth drivers for the first time since the company’s IPO. For example, emerging brands, which include Hinge and Pairs, grew revenue 88% year-over-year in Q3, resulting in non-Tinder direct revenue growing 23% year-over-year. We expect that Optionality in the form of Match Group’s existing portfolio of emerging brands will drive sustained high revenue and free cash flow growth over the coming years. “

Nejron Photo/Shutterstock.com

Last December 2020, we published an article telling that Match Group, Inc. (NASDAQ: MTCH) was in 61 hedge fund portfolios, its all time high statistics. MTCH delivered a -6.74% return YTD.

As of September 2020, ShawSpring Partners had a 779K share position in WORK that amounted to $86.2 million. However, our calculations showed that Match Group, Inc. (NASDAQ: MTCH) does not belong to the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 216% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 121 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website.

Suggested Articles:

- Cathie Wood’s Top 10 Small-Cap Stock Picks

- 10 Best Aggressive Stocks to Buy Now

- 12 Best Utility Stocks To Buy Now

Disclosure: None. This article is originally published at Insider Monkey.