Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Ophthotech Corp (NASDAQ:OPHT).

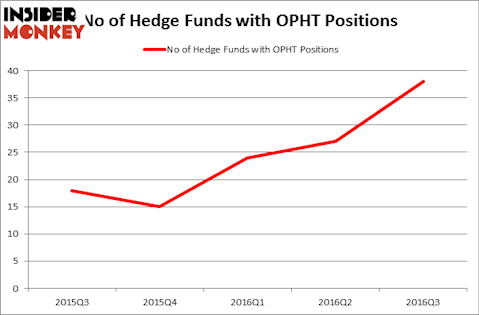

Is Ophthotech Corp (NASDAQ:OPHT) undervalued? The best stock pickers are in a bullish mood. The number of bullish hedge fund bets jumped by 11 in recent months. OPHT was in 38 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with OPHT holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Granite Construction Inc. (NYSE:GVA), Cardtronics, Inc. (NASDAQ:CATM), and GATX Corporation (NYSE:GATX) to gather more data points.

Follow Iveric Bio Inc. (NASDAQ:ISEE)

Follow Iveric Bio Inc. (NASDAQ:ISEE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: hafakot / 123RF Stock Photo

Now, let’s analyze the recent action surrounding Ophthotech Corp (NASDAQ:OPHT).

Hedge fund activity in Ophthotech Corp (NASDAQ:OPHT)

At Q3’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 41% jump from the second quarter of 2016. Hedge fund ownership of the stock has now risen by 150% since the end of 2015. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, JHL Capital Group, managed by James H. Litinsky, holds the largest position in Ophthotech Corp (NASDAQ:OPHT). JHL Capital Group has a $138.4 million position in the stock, comprising 9.1% of its 13F portfolio. Sitting at the No. 2 spot is Samuel Isaly of OrbiMed Advisors, with a $53.8 million position. Other peers that hold long positions include Matthew Sidman’s Three Bays Capital, Steve Cohen’s Point72 Asset Management and Jeremy Green’s Redmile Group.