We recently compiled a list of the 10 Best Semiconductor Stocks to Buy for the AI Boom. In this article, we are going to take a look at where Intel Corporation (NASDAQ:INTC) stands against the other semiconductor stocks.

More than two years have passed since the proliferation of the disruptive Artificial Intelligence (AI) megatrend, symbolically marked by the launch of OpenAI’s revolutionary product – ChatGPT. Since then, the AI revolution has accelerated rapidly, with 2023 and 2024 seeing a surge in demand for advanced AI applications across industries. This transformation has driven companies to increasingly rely on robust data centers that can support the computational power required by the intelligent algorithms.

In tandem with the rise of AI, the data center sector has experienced substantial growth. The need for larger, more efficient, and scalable data storage and processing capabilities has created a boom in infrastructure investments. Data centers, which house the powerful servers needed for AI workloads, have become critical enablers of this technology’s expansion. This increase in demand for data center capacity is a key factor that has propelled semiconductor stocks, as these centers rely heavily on cutting-edge semiconductors to deliver the speed, efficiency, and power necessary to process vast amounts of data in real time.

Our Methodology

We shortlisted 35 semiconductor stocks using the holdings of iShares’ Semiconductor ETF. Then we merged these stocks with Insider Monkey’s proprietary hedge fund holdings database and identified the 10 most popular hedge fund semiconductor stocks. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

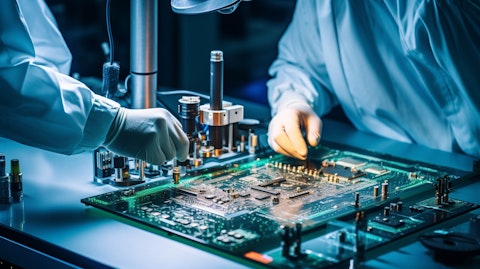

A technician soldering components for a semiconductor board.

Intel Corporation (NASDAQ:INTC)

Number of Hedge Fund Holders: 68

Intel Corporation (NASDAQ:INTC) is a leading chipmaker specializing in designing and manufacturing microprocessors for global PC and data center markets, where it holds a dominant market share in CPUs. Known for pioneering x86 microprocessor architecture and advancing Moore’s Law, Intel is now expanding into new areas like communications, automotive, and IoT, while leveraging its manufacturing expertise to establish an outsourced foundry model for producing chips for other companies.

It is undoubted that INTC has experienced a difficult 2024, marked by disappointing 2H 2024 results which led to dividend suspension, a 15% cut in workforce and major restructuring plans being announced. These events have pushed the stock price down by -58% in the last year and led to the departure of the CEO Pet Gelsinger. The appointment of a new CEO has set the stage for a multi-year transformation plan for INTC. The company’s new CEO commented on his long-term approach and how it differs from the previous strategy during Barclays 22nd Annual Global Technology Conference. Here is what he said:

“Well, I think there’ll be a few differences and there’ll be a few things that don’t change. Obviously, building world-class products and a world-class foundry, we’re still highly invested in doing that. And those 2 things together will help differentiate us in the marketplace.

Dave and I enjoyed working with Pat and he left us in a better operational place. But I think Dave and I will both tell you that as the CEO of Intel Products, we’re going to invest more in products, be focused on making sure that we shore up those road maps, that we’re more competitive in a lot of the growth markets than we have been historically. And that will then fill the fabs, right? So great products mean more wafers, which means better capacity in our fabs. As well as we’re laser focused. We’ve obviously made very large investments in our fab footprint, and we need a much better ROI for the investment that we’ve made. So, we’re going to be laser focused on how do we take advantage of the investments we made, how do we bring customers into those fabs and start to see wafers fill them.”

Overall INTC ranks 9th on our list of the best semiconductor stocks to buy for the AI boom. While we acknowledge the potential of INTC as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than INTC but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. This article is originally published at Insider Monkey.