We recently compiled a list of the 11 Best Cosmetic Surgery and Aesthetics Stocks to Invest in Now. In this article, we are going to take a look at where Establishment Labs Holdings Inc. (NASDAQ:ESTA) stands against the other cosmetic surgery and aesthetics stocks.

In the face of economic uncertainty, consumer preferences in the beauty industry are changing. A Bloomberg Intelligence poll conducted in June 2024 with 650 participants found that 40% of respondents gave beauty and personal care purchases more importance than other products. Nonetheless, this represents the lowest result since the survey’s launch two years ago, a 10-percentage-point drop from January.

Despite the continued success of premium cosmetic products, there is less demand for mainstream, reasonably priced products, which make up the majority of the market. Leonard Lauder’s “Lipstick Index” theory, which associates economic slowdowns with increased spending on self-care, seems less sound these days. Although the beauty industry has grown significantly over the last five years, Andrea Felsted, a Bloomberg Opinion columnist, observes that customer interests are beginning to shift.

This drop in affordable beauty purchases raises questions about how well the industry can withstand economic downturns. The results point to changing customer behavior, with high-end products performing better and less expensive markets being squeezed during difficult economic conditions.

Amidst this shift, according to Ulta CEO Dave Kimbell, younger generations, Gen Z and Gen Alpha, are more willing to spend money on beauty than previous generations, especially on skincare or as a way to express themselves. He also mentioned that a growing percentage of Americans are Hispanic consumers, who are more likely to be active in the area. Here are some comments from Kimbell:

“While we anticipate that some of these headwinds will persist in the near term, we are confident in our ability to deliver on our plans and set ourselves up for long-term growth.”

Meanwhile, the market for medical aesthetics, or procedures meant to enhance patients’ physical attractiveness, is expected to grow in the future. According to research by senior partner Olivier Leclerc and colleagues, the CAGR for neuromodulators like Botox is anticipated to reach 11.9 percent in the US and Canada by 2025. By 2025, the compound annual growth rate for injectable dermal fillers, such as biostimulators and hyaluronic acid fillers, may reach 3.8 percent. Moreover, as per McKinsey’s research report, through 2025, the medical aesthetics industry is expected to continue growing at a rate close to double digits.

In one of the recent developments, finance solutions like “buy-now, pay-later” loans are being given to make cosmetic procedures more affordable because of the rising demand for these procedures in the United States, as reported by Bloomberg. While the demand spike from the pandemic has subsided, rates of aesthetic procedures are still substantially higher than they were before COVID, with a 2023 increase over 2024, according to a June 2024 study from the American Society of Plastic Surgeons.

Financing programs that divide expenses ranging from $200 to $10,000 into smaller installments over three to sixty months are now advantageous for facial procedures and other treatments. These choices are especially appealing to younger consumers because they frequently include interest-free terms and low credit requirements. According to Bloomberg, sales of asset-backed securities in the United States have increased by almost 20% year over year, reflecting this trend in the larger financial market. This highlights the connection between high customer demand and innovative financial solutions.

Our Methodology:

In this article, we first used a stock screener, to list down all Cosmetic Surgery and Aesthetics Stocks (as of the writing of this article) with the highest institutional ownership. From the resultant dataset, we chose 11 stocks with the highest number of hedge fund investors, using Insider Monkey’s database of 900 hedge funds in Q3 2024 to gauge hedge fund sentiment for stocks.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here)

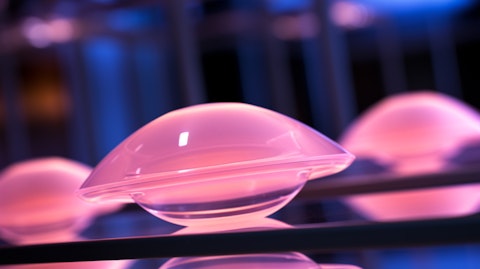

A close-up of a silicone gel-filled breast implant with a Motiva logo in the background.

Establishment Labs Holdings Inc. (NASDAQ:ESTA)

Number of Hedge Fund Holders: 24

One of the Best Aesthetics Stocks, Establishment Labs Holdings Inc. (NASDAQ:ESTA) is a medical technology business that sells both cosmetics and medical equipment. It works on the development, production, and distribution of silicone-filled breast and body-shaping implants. The Motiva Implants brand is used by the business to market its products. Through direct sales, it distributes its products to physicians, clinics, hospitals, and medical distributors. Its geographical divisions include Asia-Pacific/Middle East, Europe, Latin America, and others.

Revenue increased by 4.47% year over year in Q3 2024 as a result of higher account onboarding and strong initial demand for Motiva Implants in the U.S. after FDA approval. In just three weeks after launch, Motiva Implants onboarded over 250 new accounts, and they are now adding 15 accounts per day. Moreover, Establishment Labs Holdings Inc. (NASDAQ:ESTA) is focusing on global expansion, with revenue in the United States likely to exceed $35 million by 2025.

BTIG maintained a Buy rating on the shares and increased the price target for Establishment Labs Holdings Inc. (NASDAQ:ESTA) from $62 to $65 on October 14, 2024, as part of an updated research note that previewed the Q3 MedTech results. In a research note, the analyst informed investors that the sector had “solid returns”. These results largely align with fundamental feedback during Q3, as procedure volumes have been healthy and demand is strong. According to the firm, channel assessments in numerous subsectors also indicate that procedure demand would remain strong through 2025 due to support from low unemployment and demographics.

Wilmot B. Harkey And Daniel Mack’s Nantahala Capital Management was the largest stakeholder in the company from among the funds in Insider Monkey’s database. It owns more than 2.3 million shares worth $102.08 million as of Q3.

Overall ESTA ranks 6th on our list of the best cosmetic surgery and aesthetics stocks to invest in now. While we acknowledge the potential for ESTA as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ESTA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.