We recently compiled a list of the Dividend Kings List: Top 15. In this article, we are going to take a look at where Consolidated Edison, Inc. (NYSE:ED) stands against the other dividend kings you should know about.

Dividend Kings are a distinguished group of companies that have achieved at least 50 consecutive years of dividend increases. While some of these companies are part of the S&P index, the two categories are not entirely overlapping. The appeal of Dividend Kings became especially clear after the disruptions caused by the COVID-19 pandemic in 2020. During this time, numerous companies either reduced or suspended their dividends, leaving income-focused investors disappointed. Many had assumed that dividend-paying stocks were inherently lower risk, only to face steep share price drops alongside payout cuts. However, Dividend Kings stand out for their remarkable consistency, boasting 50 years of uninterrupted dividend increases. This long history of reliable payouts provides a sense of stability, even in volatile market conditions.

Investors often gravitate toward firms with a track record of consistent dividend growth, as such companies tend to perform well in declining or stagnant markets. Even during periods of strong market performance, dividend growers have captured a significant share of the gains. Following a long-term dividend growth strategy can aid in compounding returns for investors. A T. Rowe Price report highlighted that, between 1985 and 2022, companies in the Russell index that consistently increased dividends outperformed the broader benchmark. Furthermore, these companies exhibited lower price volatility compared to the overall market.

Earning income through dividend stocks is a gradual process that requires patience and a commitment to long-term investing. These stocks are particularly suited for investors with a long-term horizon, as they have consistently outpaced inflation over time. According to data from Morningstar and Yale University’s Robert Shiller, since 1871, the market’s dividends per share have grown at an annualized rate 1.6 percentage points higher than inflation. Moreover, the gap between dividend growth and inflation has widened in recent years. Over the past 50 years, dividends have outpaced inflation by 2.5 percentage points annually, and in the last 20 years, the margin has grown to 4.6 percentage points per year.

During market rallies, dividend-growing stocks may underperform as investor enthusiasm and momentum often take precedence over fundamentals such as valuation and business quality. This trend has been especially noticeable in the recent past, with dividend stocks lagging behind the broader market. Nonetheless, maintaining a long-term strategy centered on dividend growth can be advantageous, as the benefits accumulate over time with each increase in payouts. Companies with solid fundamentals and robust financial stability are typically well-positioned to sustain and grow their dividends. In contrast, smaller or emerging businesses often prioritize reinvesting earnings into their operations to fuel growth. Given this, we will take a look at some of the best dividend kings with the highest yields.

Our Methodology:

To create this list, we examined a set of over 50 dividend king companies, recognized for consistently increasing dividends for 50 years or more. From this group, we selected companies with the highest dividend yields as of December 3 and organized them in ascending order based on their yield, from lowest to highest. We also measured hedge fund sentiment around each stock according to Insider Monkey’s database of 900 as of Q3 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

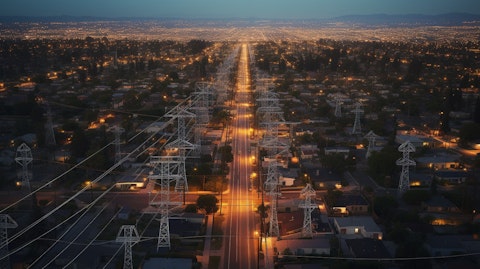

Aerial view of transmission and distribution substations providing electricity to residential and commercial customers.

Consolidated Edison, Inc. (NYSE:ED)

Dividend Yield as of December 3: 3.35%

Consolidated Edison, Inc. (NYSE:ED) ranks twelfth on our list of the best dividend kings. The American energy company remains dedicated to fulfilling its obligations to shareholders, now targeting the distribution of 55% to 65% of its adjusted earnings as dividends, a reduction from the earlier goal of 60% to 70%. This shift allows the company to retain more of its earnings to fund internal growth initiatives. This approach is anticipated to enhance earnings per share growth, potentially increasing overall returns by combining dividend payouts with stock price appreciation as earnings improve. Since the start of 2024, the stock has surged by over 6.6%.

Consolidated Edison, Inc. (NYSE:ED) reported strong earnings in the third quarter of 2024. The company’s revenue came in at $4.09 billion, which showed a 5.7% growth from the same period last year. The revenue also surpassed analysts’ estimates by $25.5 million. The company reported that its programs successfully reduced electric demand during another hot summer in New York, ensuring uninterrupted power supply for customers. As New Yorkers increasingly adopt electrification for building heating and transportation, the company has streamlined the process for installing EV chargers and continues to offer incentives for heat pump installations.

On October 17, Consolidated Edison, Inc. (NYSE:ED) declared a quarterly dividend of $0.83 per share, which fell in line with its previous dividend. The company has never missed a dividend since 1885 and has raised its payouts for 50 years in a row. The stock’s dividend yield on December 3 came in at 3.35%.

As per Insider Monkey’s database of Q3 2024, 29 hedge funds owned stakes in Consolidated Edison, Inc. (NYSE:ED), compared with 32 in the preceding quarter. These stakes have a collective value of over $601.8 million.

Overall ED ranks 12th on our list of the dividend kings you should know about. While we acknowledge the potential of ED as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ED but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.