The technology industry is a very dynamic industry per se, and to add to that, as Robert Kiyosaki puts it, the tech sector has currently been the “flavor of the month” for quite some time. Now that leads to a major problem. Average people tend to invest money in an industry that is in the press. And the dynamism of the industry takes the stability factor out of it. So you are left with a game where short term returns are dependent upon market emotion, creating a higher chance of failure.

As a clear case of confusion between this fundamental and technical investing, let us look at an example of two tech giants, Intel Corporation (NASDAQ:INTC) and Apple Inc. (NASDAQ:AAPL). What has primarily gained my attention is the graph below.

Essentially, Apple Inc. (NASDAQ:AAPL)’s stock price has returned 262.01% in the last five years, compared to a shameful 3.85% for Intel. Needless to say, while I am not saying that Apple is of no value, it is also an example of how people can sometimes keep investing based on market emotions. On the other hand, Intel might make a strong case of fundamental investing for clever investors here. In other words, while you might be more inclined to invest in Apple Inc. (NASDAQ:AAPL) (as you are governed by market emotions), there is a strong chance that you are missing a value stock, that is, Intel.

Reasons for Choosing Intel over Apple Inc. (NASDAQ:AAPL)

More focus on Android powered -smartphones – In January 2013, Intel entered into Africa when Kenyan wireless operator and Intel partner Safaricom revealed the continent’s first Intel smartphone, the Android-powered Yolo. It already has plans to enter into other countries such as China, India, Latin America and Southeast Asia.

At the CES 2013, Intel Corporation (NASDAQ:INTC) already announced some improvements in its foray in the mobile chip processor market. Here is an excerpt from this article:

“Today, after a year of preparation, Intel announced the Bay Trail-T microprocessor and the Bay Trail-T tablets that manufacturers are developing for both Windows 8 and Android. The Bay Trail-T is a shrink to 22 nm and enhancement of the Atom Medfield chip currently in production that will deliver as much as twice the performance with extended battery life. The Bay Trail-T is a compatible Wintel microprocessor which will run Windows 8 and any Windows app as well and Android and Android apps. This is an advantage over the ARM powered Microsoft Surface that runs a Microsoft variant called Windows RT that only runs Windows applications that have been re-coded and recompiled.

In February at the Mobile World Congress in Barcelona, Intel is expected to update its investors and partners on its Merrifield processor due to be launched later in 2013. Merrifield, first announced in May 2012 at Intel’s investor conference, is targeted at smartphones, a shrink to 22 nm with performance improvements similar to the Bay Trail-T. Intel has begun production of its LTE/4G baseband chip, according to Intel’s spokesman Jon Carville.”

Is Intel’s focus on Android-powered phones viable enough? Of course, it is. Google Inc (NASDAQ:GOOG)’s Android surged to a whopping 75% share of the global smartphone market in the Q3FY12, according to this article. That’s over four times the 14.9% market share held by Apple Inc. (NASDAQ:AAPL)’s iOS.

If the new Intel Corporation (NASDAQ:INTC)-branded chip does well in the 2013 market, we will probably see further growth in the bottom line of the company, which will likely reflect in its share price. On the other hand, unless Apple gains sufficient market share with its latest iPhones and iPads in a year or two, its stock price can be hit hard and will probably tank.

When you are investing in Intel Corporation (NASDAQ:INTC), you are not only investing in its strong technical prowess in the semiconductor industry, but also in Android’s future potential in the global market, which seems far more attractive when compared with iOS.

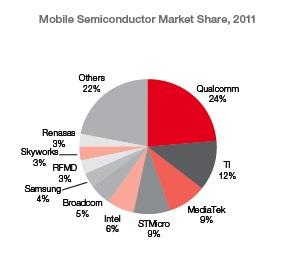

Economic moat around the company – Again, we are talking about a company that has a market worth of over $100 billion and over 57% share in the microprocessor chip market. Although Qualcomm (NASDAQ:QCOM) occupies around 24% share in the mobile semiconductor market, as last reported in 2011, one thing can set Qualcomm back. It does not have as strong a brand as Intel. Consumers buy electronic devices on the very premise that they use Intel’s chips. People trust and rely on the quality of Intel’s products. Intel’s revenue is governed mostly by its technologically sound and market ready products it manufactures. Do you think Intel might not be able to gain that in the mobile market as well?

On the other hand, I have strong conviction that Apple competes more on brand preference and design. It is basically the “coolness” factor that drives Apple’s revenue. Nonetheless, it will be harder (and more expensive) than most people think for Apple to remain as dominant as it is today.

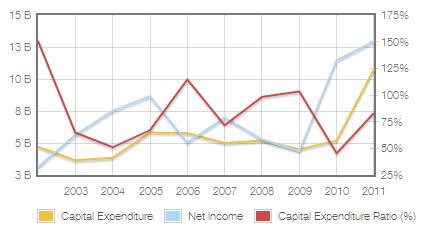

Moreover, the biggest entry barrier to the semiconductor industry is the amount of capital expenditure required for a full-fledged business. Intel’s research and development (R&D) expenditures were $8.4 billion in 2011 ($6.6 billion in 2010 and $5.7 billion in 2009). And with some new products in the pipeline, it might increase in 2013. Here is the capex ratio of Intel.

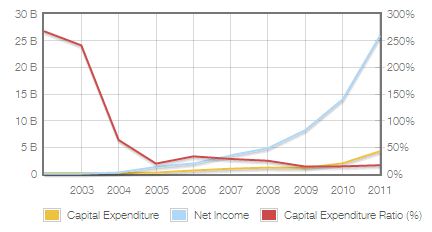

It stands well over a whopping 75%! In comparison to that, here is the capex ratio of Apple.

From the graph above, either Apple is not investing enough in its capital assets or the business it is in does not require high capital expenditure. In either case, lower capex requirement means lower economic moat for the company.

Return on shareholders’ equity – In 2012, Intel earned more than $20 billion in cash. With this huge profit, Intel spent more than $16 billion returning capital to its owners via cash dividends ($4 billion) and share buybacks ($12 billion). In other words, shareholders at Intel kept 80% of the profits. Doing the math, while Intel is worth $100 billion in the market, the current shareholder yield (including cash and share buyback) stands now at over 16%.

On the other hand, Apple earned $50 billion in cash last year. How much was returned to shareholders? Almost nothing, considering the huge cash hoard of around $137 billion – the shareholders got only $4.5 billion in total dividends (cash and net share buybacks). The company retained more than 90% of its earnings. With Apple’s market value around $420 billion, the current shareholder yield (including cash and share buyback) stands now around 1%.

In addition to that, let us take a look at the technical price chart of Intel.

Conclusion

While Intel might not be the market’s favorite at the moment, it might be a folly to overlook the potential of the stock at this moment. Remember Warren Buffett’s famous rule of thumb: Buy when others are selling; sell when others are buying.

With a severely oversold market condition, strong fundamentals, and solid revenue growth potential, Intel just might turn out to be a growth stock disguised as a value stock.

The article Why Intel Might be a Better Investment Than Apple originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.