We recently published a list of Why These 15 Data Center Stocks Are Skyrocketing So Far In 2025. In this article, we are going to take a look at where Intel Corp (NASDAQ:INTC) stands against other data center stocks that are skyrocketing so far in 2025.

There have been murmurs of a data center and cloud computing slowdown for the past two years, but none of that has materialized and the data center industry has instead accelerated as companies double down on AI. Even after DeepSeek, investors are pretty bullish on data center stocks as AI companies are learning from DeepSeek’s efficiency to create even more powerful AI models.

The data center sector is projected to grow at a 9.29% CAGR from 2025 to 2033, potentially reaching $494.5 billion by 2033. As such, there are plenty of opportunities if you dig deeper into the market and many of them have just started to rally this year. It’s a good idea to look into the ones spearheading the gains.

Methodology

For this article, I screened the top-performing data center stocks year-to-date. Stocks that I have covered recently will be excluded from this list.

I will also mention the number of hedge fund investors in these stocks. Why are we interested in the stocks that hedge funds invest in? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

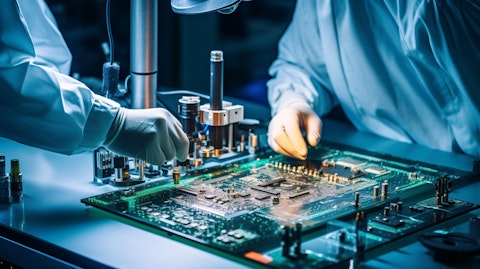

A technician soldering components for a semiconductor board.

Intel Corp (NASDAQ:INTC)

Number of Hedge Fund Holders In Q4 2024: 83

Intel Corp (NASDAQ:INTC) makes semiconductors and other computing products that are widely used in data centers.

The stock is up significantly so far in 2025 as there are talks swirling around of a potential break-up of the company. Apparently, Broadcom is exploring the acquisition of Intel’s chip design business while TSMC is considering taking control of manufacturing facilities. Meanwhile, Silver Lake Management is nearing a deal to acquire a majority stake in Intel’s Altera programmable chips unit.

Intel is also receiving tailwinds from the Trump administration’s support for domestic AI chip manufacturing.

The consensus price target of $26.9 implies 4.39% upside.

INTC stock is up 27.63% year-to-date.

Overall, INTC ranks 7th on our list of data center stocks that are skyrocketing so far in 2025. While we acknowledge the potential of INTC as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than INTC but that trades at less than 5 times its earnings, check out our report about thecheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.