When people think of precious metals investing, usually an image of gold bars or coins comes to mind. However, this initial idea does not begin to scratch the surface of precious metals investing. This type of thinking overlooks the fact that many buy silver or other metals like platinum, palladium, and rhodium. Not every bullion investor buys silver because it is a smaller market and does not carry the same value as gold. So, you might be wondering why buy silver now if gold is more precious? What is there to gain from investing in silver? For starters, it is important to know how the market works and why Biden’s presidency spells a higher silver price in the near future.

Q3 2020 hedge fund letters, conferences and more

A First Look at Investing in Silver

Silver offers a cheaper alternative to gold bullion, and it serves the same purpose. Most run to precious metals during economic uncertainty to protect from inflation or crashes. However, most people run to gold first because they believe it is a better hedge. Actually, silver bullion plays the same role, and it is more affordable for most.

To start, silver bullion actually tends to outperform gold in the market. Silver is a relatively small market, so although it has comparatively more volatility than gold, this also means silver will see major increases from even just a little money moving into the market. Consequently, a silver bull market tends to increase in value greater and faster than gold. Basically, the percentages for silver versus gold show more positive growth in favor of silver.

Investing in silver also offers the benefit of solitary ownership and easy management. As long as you know how to safely store your silver bullion, you might not need to rely on a third party to control your safe-haven assets. Once you own silver bullion, it belongs to you, and it cannot be hacked. Yes, you have to worry about counterfeits, but not if you buy from only legitimate sources. So, your main concern would be theft, but if you have a secure place to keep your silver bullion, you probably have nothing to worry about.

Why Buy Silver Now: A Look into the New US Presidency

Demand continues to grow for silver, which is why it is a good idea to invest in silver. But you may still be asking: why buy silver now? Knowing where the most demand for silver exists will help you see exactly why investing in silver now can be a great idea.

Biden’s Presidency: Why Buy Silver Now

Firstly, Joe Biden won the US 2020 election. As a major supporter of the Green New Deal, Biden’s impact on the silver price is inevitable. Silver is one of the best conductors of electricity and heat, and one of the most light-sensitive metals in the world. This makes it ideal for solar panels on top of its preexisting use in batteries, for purifying water, and in the fabrication of control rods in nuclear reactors. On President Biden’s campaign website, it is written:

“We can lead America to become the world’s clean energy superpower. We can export our clean-energy technology across the globe and create high-quality, middle-class jobs here at home. Getting to a 100% clean energy economy is not only an obligation, it’s an opportunity.”

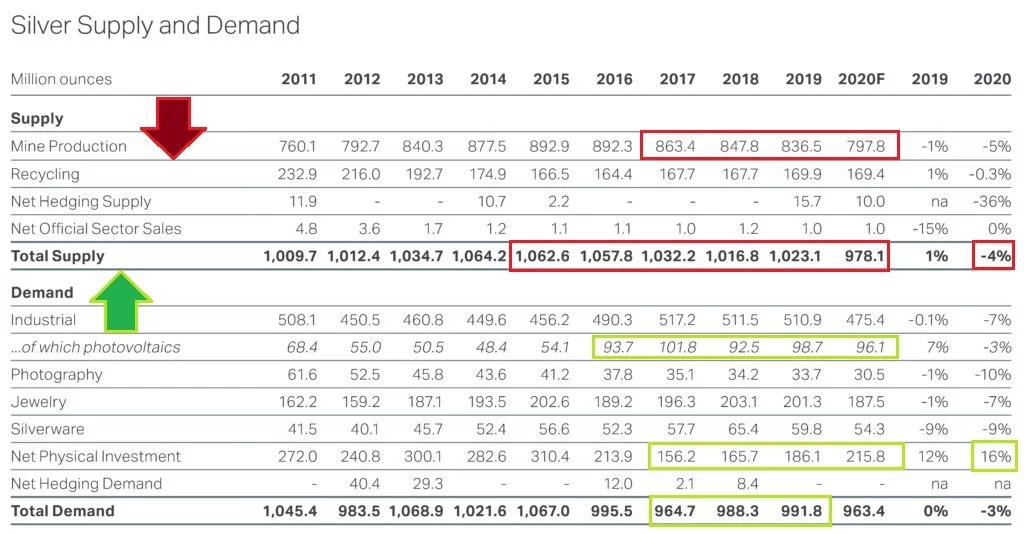

Biden’s aggressive stance on climate change goes to show that the US will shift to greener technology on a national scale. Therefore, silver demand will climb if he holds up his promise to fight against climate change. However, this comes with a price. The silver supply has reportedly already peaked. After the silver crash in 2011, fewer mines are open, and there are not many efforts to reopen or replace the closed mines.

Source: The Silver Institute

It is important to note in this image that the demand for silver declined in 2020. However, do not forget that the pandemic forced the entire world to temporarily halt business. The fact that despite the pandemic the silver demand is only down 3% this year so far is remarkable. As the economy continues to reopen and repair internationally, the silver price demand on the industrial front may increase.

Invest in Silver For a Brighter Future

In summary, silver is a physical asset with no real downside of owning, and you can sell it at any time. It is a strong hedge for portfolios and helps protect your assets from inflation or crashes. Its fundamental factors will drive the price even higher over time for the simple reason that demand will outweigh the supply. As long as you buy only from reputable dealers, buying silver bullion is one of the least risky investments you can make.

There are plenty of reasons to buy silver no matter what kind of investor you are. If you are looking to increase your wealth, silver is an industry that has significant room for growth. As the world turns to comply with the Paris Agreement, especially in China and India, the demand for silver will rise. If you are still wondering ‘why buy silver now?’ The answer is simply to guarantee a return on investment for the future in the long term. As news of a vaccine against the coronavirus emerges this week, the economy may be able to start reopening. Biden’s new plans for a greener America may start as early as the beginning few months of 2021.

By Eric Gozenput