Should you be bullish on Anheuser-Busch InBev SA NV (ADR) (NYSE:BUD), Liberty Broadband Corp (NASDAQ:LBRDK), Yum! Brands, Inc. (NYSE:YUM), and Walgreens Boots Alliance Inc (NASDAQ:WBA)? According to our research, an investor can beat the market by investing in the top picks of big hedge funds. We follow around 750 funds, among which is Eric W. Mandelblatt‘s Soroban Capital Partners, which had all four of those companies among its top consumer picks. Therefore, we decided to examine these stock, see how did they perform in the third quarter, and what was the general smart money sentiment towards them.

At the end of June, Soroban Capital Partners’ portfolio was valued at $16.25 billion. The fund’s 16 holdings in companies with a market cap of at least a billion dollars brought a weighted average return of 15.32% in the third quarter. Our calculations will differ from the fund’s actual returns, seeing as we don’t include short positions and some other instruments. Nevertheless, our methodology provides a great tool for analyzing the hedge fund’s investment skills in long positions in non-volatile stocks. With that in mind, let’s take a closer look at Soroban Capital Partners’ top consumer picks.

The first stock we are going to examine is Belgium-based brewing company Anheuser-Busch InBev SA NV (ADR) (NYSE:BUD). During the June quarter, Soroban Capital Partners lowered its stake in the company by 3%, to 7.30 million shares, which were valued at $961.45 million, comprising 5.92% of its equity portfolio’s value. In the third quarter, the stock delivered a negative return of 0.2%.

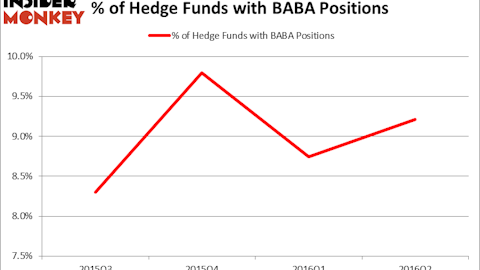

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 9% from the first quarter of 2016. Among the biggest investors in Anheuser-Busch InBev SA NV (ADR) (NYSE:BUD) were Gardner Russo & Gardner, Fisher Asset Management, and Lone Pine Capital.

Follow Anheuser Busch Inbev Sa Nv (NYSE:BUD)

Follow Anheuser Busch Inbev Sa Nv (NYSE:BUD)

Receive real-time insider trading and news alerts

Next in line is Liberty Broadband Corp (NASDAQ:LBRDK), which delivered a positive return of 19.1% during the third quarter. Considering this return, the fund made a great addition to its portfolio, when it acquired 8.89 million shares of Liberty Broadband Corp (NASDAQ:LBRDK) in the June quarter, creating a stake that was valued at $533.52 million on June 30, comprising 3.28% of its portfolio.

At the end of the second quarter, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 10% increase from the first quarter of 2016. Of the funds tracked by Insider Monkey, JANA Partners, managed by Barry Rosenstein, held the largest position in Liberty Broadband Corp (NASDAQ:LBRDK). JANA Partners had a $552.5 million position in the stock, comprising 9.4% of its 13F portfolio. Coming in second was Coatue Management, led by Philippe Laffont, holding a $533.5 million position. Other peers that were bullish encompassed George Soros’ Soros Fund Management and Wallace Weitz’s Wallace R. Weitz & Co.

Follow Liberty Broadband Corp (NASDAQ:LBRDK)

Follow Liberty Broadband Corp (NASDAQ:LBRDK)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.