After several tireless days we have finished crunching the numbers from nearly 817 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Trinity Place Holdings Inc. (NYSE:TPHS).

Hedge fund interest in Trinity Place Holdings Inc. (NYSE:TPHS) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that TPHS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as 1895 Bancorp of Wisconsin, Inc. (NASDAQ:BCOW), Yatra Online, Inc. (NASDAQ:YTRA), and Happiness Biotech Group Limited (NASDAQ:HAPP) to gather more data points.

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Michael Price of MFP Investors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to take a peek at the recent hedge fund action encompassing Trinity Place Holdings Inc. (NYSE:TPHS).

How have hedgies been trading Trinity Place Holdings Inc. (NYSE:TPHS)?

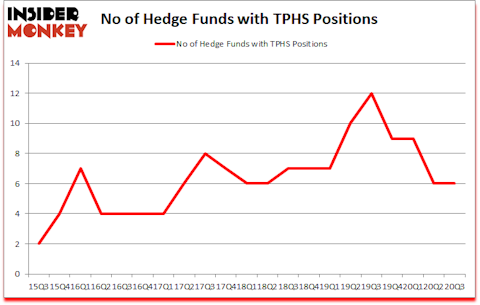

At the end of September, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TPHS over the last 21 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, MFP Investors, managed by Michael Price, holds the number one position in Trinity Place Holdings Inc. (NYSE:TPHS). MFP Investors has a $9.5 million position in the stock, comprising 1.7% of its 13F portfolio. On MFP Investors’s heels is Martin Whitman of Third Avenue Management, with a $8.6 million position; 1.2% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions contain Kahn Brothers, Phillip Goldstein, Andrew Dakos and Steven Samuels’s Bulldog Investors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position MFP Investors allocated the biggest weight to Trinity Place Holdings Inc. (NYSE:TPHS), around 1.72% of its 13F portfolio. Third Avenue Management is also relatively very bullish on the stock, designating 1.19 percent of its 13F equity portfolio to TPHS.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: MD Sass. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s go over hedge fund activity in other stocks similar to Trinity Place Holdings Inc. (NYSE:TPHS). These stocks are 1895 Bancorp of Wisconsin, Inc. (NASDAQ:BCOW), Yatra Online, Inc. (NASDAQ:YTRA), Happiness Biotech Group Limited (NASDAQ:HAPP), Village Bank and Trust Financial Corp. (NASDAQ:VBFC), CLPS Incorporation (NASDAQ:CLPS), Miragen Therapeutics (NASDAQ:MGEN), and T.A.T. Technologies Ltd. (NASDAQ:TATT). This group of stocks’ market values resemble TPHS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCOW | 2 | 159 | 0 |

| YTRA | 8 | 15460 | -3 |

| HAPP | 2 | 602 | 0 |

| VBFC | 1 | 767 | 0 |

| CLPS | 1 | 118 | 0 |

| MGEN | 2 | 187 | 0 |

| TATT | 1 | 1070 | 0 |

| Average | 2.4 | 2623 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.4 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $20 million in TPHS’s case. Yatra Online, Inc. (NASDAQ:YTRA) is the most popular stock in this table. On the other hand Village Bank and Trust Financial Corp. (NASDAQ:VBFC) is the least popular one with only 1 bullish hedge fund positions. Trinity Place Holdings Inc. (NYSE:TPHS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TPHS is 55.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through November 27th and beat the market again by 16.1 percentage points. Unfortunately TPHS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TPHS were disappointed as the stock returned -6.4% since the end of September (through 11/27) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Trinity Place Holdings Inc. (OTC:TPHS)

Follow Trinity Place Holdings Inc. (OTC:TPHS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.