In this article we will check out the progression of hedge fund sentiment towards Ozon Holdings PLC (NASDAQ:OZON) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

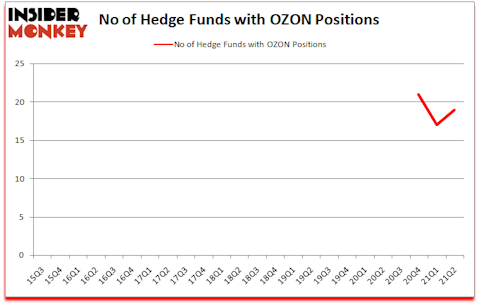

Ozon Holdings PLC (NASDAQ:OZON) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Ozon Holdings PLC (NASDAQ:OZON) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 21. Our calculations also showed that OZON isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

According to most traders, hedge funds are assumed to be underperforming, old investment vehicles of yesteryear. While there are more than 8000 funds with their doors open today, Our experts look at the elite of this club, approximately 850 funds. These hedge fund managers orchestrate the majority of all hedge funds’ total asset base, and by paying attention to their top picks, Insider Monkey has unearthed numerous investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Christian Leone of Luxor Capital Group

With all of this in mind we’re going to take a look at the recent hedge fund action regarding Ozon Holdings PLC (NASDAQ:OZON).

Do Hedge Funds Think OZON Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from the first quarter of 2020. On the other hand, there were a total of 0 hedge funds with a bullish position in OZON a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chase Coleman’s Tiger Global Management LLC has the number one position in Ozon Holdings PLC (NASDAQ:OZON), worth close to $44 million, amounting to 0.1% of its total 13F portfolio. The second most bullish fund manager is Richard Driehaus of Driehaus Capital, with a $30.8 million position; 0.4% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism comprise Christian Leone’s Luxor Capital Group, David Halpert’s Prince Street Capital Management and Christian Leone’s Luxor Capital Group. In terms of the portfolio weights assigned to each position Prince Street Capital Management allocated the biggest weight to Ozon Holdings PLC (NASDAQ:OZON), around 14.06% of its 13F portfolio. Think Investments is also relatively very bullish on the stock, designating 2.31 percent of its 13F equity portfolio to OZON.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Luxor Capital Group, managed by Christian Leone, established the biggest position in Ozon Holdings PLC (NASDAQ:OZON). Luxor Capital Group had $29.4 million invested in the company at the end of the quarter. Christian Leone’s Luxor Capital Group also initiated a $17.6 million position during the quarter. The other funds with brand new OZON positions are Renaissance Technologies, D. E. Shaw’s D E Shaw, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Ozon Holdings PLC (NASDAQ:OZON) but similarly valued. These stocks are Dr. Reddy’s Laboratories Limited (NYSE:RDY), Jack Henry & Associates, Inc. (NASDAQ:JKHY), Tapestry, Inc. (NYSE:TPR), The Mosaic Company (NYSE:MOS), Companhia Siderurgica Nacional (NYSE:SID), Snap-on Incorporated (NYSE:SNA), and McAfee Corp. (NASDAQ:MCFE). This group of stocks’ market caps are closest to OZON’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDY | 11 | 188216 | -1 |

| JKHY | 22 | 180204 | 2 |

| TPR | 41 | 1128944 | -9 |

| MOS | 43 | 808943 | 5 |

| SID | 12 | 71048 | 2 |

| SNA | 31 | 499550 | 13 |

| MCFE | 18 | 125600 | 1 |

| Average | 25.4 | 428929 | 1.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.4 hedge funds with bullish positions and the average amount invested in these stocks was $429 million. That figure was $191 million in OZON’s case. The Mosaic Company (NYSE:MOS) is the most popular stock in this table. On the other hand Dr. Reddy’s Laboratories Limited (NYSE:RDY) is the least popular one with only 11 bullish hedge fund positions. Ozon Holdings PLC (NASDAQ:OZON) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for OZON is 46.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately OZON wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); OZON investors were disappointed as the stock returned -19.9% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Ozon Holdings Plc (NASDAQ:OZON)

Follow Ozon Holdings Plc (NASDAQ:OZON)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best American Dividend Stocks to Invest In

- 10 Most Expensive Cars In The World Of All Time

- 15 Best Medical Stocks to Invest In

Disclosure: None. This article was originally published at Insider Monkey.