Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of J. Jill, Inc. (NYSE:JILL).

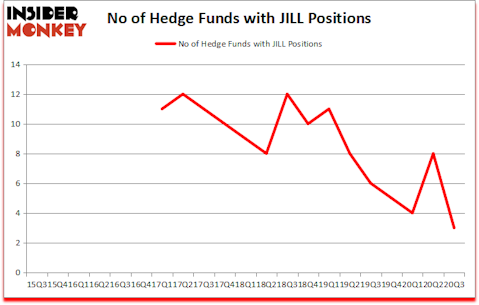

J. Jill, Inc. (NYSE:JILL) was in 3 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 12. JILL has seen a decrease in hedge fund interest recently. There were 8 hedge funds in our database with JILL holdings at the end of June. Our calculations also showed that JILL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a multitude of metrics stock traders use to assess their holdings. A pair of the less utilized metrics are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outperform their index-focused peers by a very impressive margin (see the details here).

Donald Sussman of Paloma Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to review the recent hedge fund action regarding J. Jill, Inc. (NYSE:JILL).

What does smart money think about J. Jill, Inc. (NYSE:JILL)?

At the end of September, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -63% from the second quarter of 2020. On the other hand, there were a total of 6 hedge funds with a bullish position in JILL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in J. Jill, Inc. (NYSE:JILL) was held by Renaissance Technologies, which reported holding $0.7 million worth of stock at the end of September. It was followed by Winton Capital Management with a $0.1 million position. The only other hedge fund that is bullish on the company was Millennium Management.

Because J. Jill, Inc. (NYSE:JILL) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few funds that slashed their full holdings heading into Q4. Intriguingly, Donald Sussman’s Paloma Partners dropped the biggest stake of all the hedgies followed by Insider Monkey, comprising close to $0.1 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also sold off its stock, about $0.1 million worth. These transactions are important to note, as total hedge fund interest fell by 5 funds heading into Q4.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as J. Jill, Inc. (NYSE:JILL) but similarly valued. These stocks are Midatech Pharma PLC (NASDAQ:MTP), Charles & Colvard, Ltd. (NASDAQ:CTHR), Navios Maritime Holdings Inc. (NYSE:NM), Sypris Solutions, Inc. (NASDAQ:SYPR), ENGlobal Corp (NASDAQ:ENG), HTG Molecular Diagnostics, Inc. (NASDAQ:HTGM), and Document Security Systems, Inc. (NYSE:DSS). This group of stocks’ market valuations are closest to JILL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTP | 1 | 275 | 0 |

| CTHR | 1 | 1314 | -1 |

| NM | 2 | 1452 | -1 |

| SYPR | 2 | 1013 | 1 |

| ENG | 2 | 741 | 1 |

| HTGM | 4 | 2333 | 0 |

| DSS | 1 | 74 | -1 |

| Average | 1.9 | 1029 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 1.9 hedge funds with bullish positions and the average amount invested in these stocks was $1 million. That figure was $1 million in JILL’s case. HTG Molecular Diagnostics, Inc. (NASDAQ:HTGM) is the most popular stock in this table. On the other hand Midatech Pharma PLC (NASDAQ:MTP) is the least popular one with only 1 bullish hedge fund positions. J. Jill, Inc. (NYSE:JILL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for JILL is 40.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 28.1% in 2020 through November 23rd and still beat the market by 15.4 percentage points. Hedge funds were also right about betting on JILL as the stock returned 44.4% since the end of Q3 (through 11/23) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow J.jill Inc. (NYSE:JILL)

Follow J.jill Inc. (NYSE:JILL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.