Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 900 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Hayward Holdings, Inc. (NYSE:HAYW).

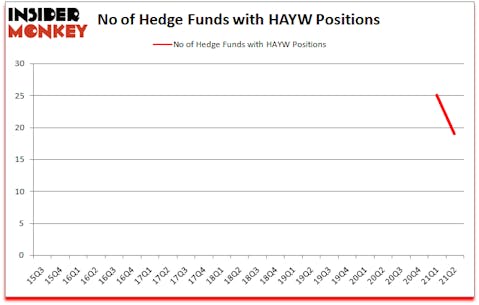

Hayward Holdings, Inc. (NYSE:HAYW) has experienced a decrease in hedge fund interest of late. Hayward Holdings, Inc. (NYSE:HAYW) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 25. Our calculations also showed that HAYW isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

Stuart Zimmer of Zimmer Partners

Now let’s take a glance at the recent hedge fund action encompassing Hayward Holdings, Inc. (NYSE:HAYW).

Do Hedge Funds Think HAYW Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from the previous quarter. On the other hand, there were a total of 0 hedge funds with a bullish position in HAYW a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Alyeska Investment Group held the most valuable stake in Hayward Holdings, Inc. (NYSE:HAYW), which was worth $86.7 million at the end of the second quarter. On the second spot was Noked Capital which amassed $43.7 million worth of shares. Zimmer Partners, Driehaus Capital, and Candlestick Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Noked Capital allocated the biggest weight to Hayward Holdings, Inc. (NYSE:HAYW), around 10.89% of its 13F portfolio. Prescott Group Capital Management is also relatively very bullish on the stock, setting aside 1.4 percent of its 13F equity portfolio to HAYW.

Judging by the fact that Hayward Holdings, Inc. (NYSE:HAYW) has witnessed bearish sentiment from hedge fund managers, we can see that there was a specific group of hedge funds that slashed their entire stakes heading into Q3. Interestingly, Phill Gross and Robert Atchinson’s Adage Capital Management cut the largest stake of all the hedgies watched by Insider Monkey, valued at close to $27 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also cut its stock, about $19.1 million worth. These moves are interesting, as aggregate hedge fund interest fell by 6 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Hayward Holdings, Inc. (NYSE:HAYW). These stocks are Eagle Materials, Inc. (NYSE:EXP), CACI International Inc (NYSE:CACI), Pan American Silver Corp. (NASDAQ:PAAS), Rexnord Corp (NYSE:RXN), NOV Inc. (NYSE:NOV), Stag Industrial Inc (NYSE:STAG), and NCR Corporation (NYSE:NCR). This group of stocks’ market values resemble HAYW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXP | 36 | 243658 | 1 |

| CACI | 26 | 491404 | 5 |

| PAAS | 24 | 312456 | -3 |

| RXN | 29 | 521863 | 4 |

| NOV | 30 | 993193 | 1 |

| STAG | 15 | 232197 | -2 |

| NCR | 38 | 526452 | 14 |

| Average | 28.3 | 474460 | 2.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.3 hedge funds with bullish positions and the average amount invested in these stocks was $474 million. That figure was $225 million in HAYW’s case. NCR Corporation (NYSE:NCR) is the most popular stock in this table. On the other hand Stag Industrial Inc (NYSE:STAG) is the least popular one with only 15 bullish hedge fund positions. Hayward Holdings, Inc. (NYSE:HAYW) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for HAYW is 30.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately HAYW wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); HAYW investors were disappointed as the stock returned -7.9% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Hayward Holdings Inc. (NYSE:HAYW)

Follow Hayward Holdings Inc. (NYSE:HAYW)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Biggest Gay Events in The U.S.

- 10 Best Dividend Stocks to Buy and Hold According to Tiger Cub Lee Ainslie

- 11 Best T-Shirt Design Websites

Disclosure: None. This article was originally published at Insider Monkey.