Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Genuine Parts Company (NYSE:GPC) to find out whether there were any major changes in hedge funds’ views.

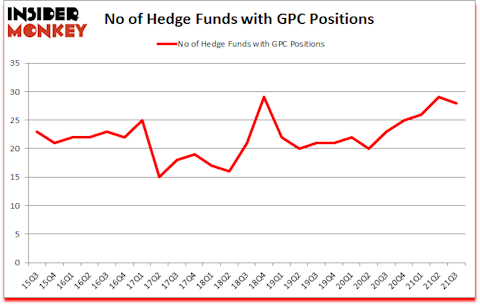

Is Genuine Parts Company (NYSE:GPC) a buy right now? Hedge funds were cutting their exposure. The number of bullish hedge fund positions were cut by 1 in recent months. Genuine Parts Company (NYSE:GPC) was in 28 hedge funds’ portfolios at the end of September. The all time high for this statistic is 29. Our calculations also showed that GPC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to take a look at the fresh hedge fund action encompassing Genuine Parts Company (NYSE:GPC).

Do Hedge Funds Think GPC Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in GPC a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Genuine Parts Company (NYSE:GPC) was held by GAMCO Investors, which reported holding $92.9 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $88.4 million position. Other investors bullish on the company included Candlestick Capital Management, AQR Capital Management, and D E Shaw. In terms of the portfolio weights assigned to each position Candlestick Capital Management allocated the biggest weight to Genuine Parts Company (NYSE:GPC), around 1.22% of its 13F portfolio. GAMCO Investors is also relatively very bullish on the stock, setting aside 0.82 percent of its 13F equity portfolio to GPC.

Since Genuine Parts Company (NYSE:GPC) has experienced bearish sentiment from hedge fund managers, logic holds that there is a sect of hedge funds that elected to cut their positions entirely in the third quarter. At the top of the heap, Dmitry Balyasny’s Balyasny Asset Management cut the biggest investment of all the hedgies followed by Insider Monkey, comprising an estimated $5.7 million in stock, and Karim Abbadi and Edward McBride’s Centiva Capital was right behind this move, as the fund dropped about $0.7 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Genuine Parts Company (NYSE:GPC) but similarly valued. These stocks are Nuance Communications Inc. (NASDAQ:NUAN), CMS Energy Corporation (NYSE:CMS), Principal Financial Group Inc (NASDAQ:PFG), Jacobs Engineering Group Inc. (NYSE:J), Lufax Holding Ltd (NYSE:LU), Avery Dennison Corporation (NYSE:AVY), and Tata Motors Limited (NYSE:TTM). This group of stocks’ market caps are closest to GPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NUAN | 61 | 4867945 | -11 |

| CMS | 25 | 415325 | -6 |

| PFG | 18 | 146441 | 0 |

| J | 20 | 955724 | -9 |

| LU | 14 | 225041 | -5 |

| AVY | 29 | 931551 | -5 |

| TTM | 10 | 90852 | 2 |

| Average | 25.3 | 1090411 | -4.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.3 hedge funds with bullish positions and the average amount invested in these stocks was $1090 million. That figure was $470 million in GPC’s case. Nuance Communications Inc. (NASDAQ:NUAN) is the most popular stock in this table. On the other hand Tata Motors Limited (NYSE:TTM) is the least popular one with only 10 bullish hedge fund positions. Genuine Parts Company (NYSE:GPC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GPC is 50.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and still beat the market by 5.1 percentage points. Hedge funds were also right about betting on GPC as the stock returned 11.4% since the end of Q3 (through 12/9) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Genuine Parts Co (NYSE:GPC)

Follow Genuine Parts Co (NYSE:GPC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Semiconductor Companies In The World

- 12 Best Marijuana Stocks to Invest In

- 15 Billionaires Who Came From Nothing

Disclosure: None. This article was originally published at Insider Monkey.