As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Advanced Drainage Systems Inc. (NYSE:WMS).

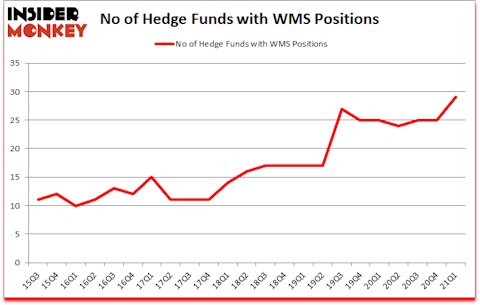

Is Advanced Drainage Systems Inc. (NYSE:WMS) ready to rally soon? Prominent investors were becoming hopeful. The number of bullish hedge fund positions moved up by 4 lately. Advanced Drainage Systems Inc. (NYSE:WMS) was in 29 hedge funds’ portfolios at the end of March. The all time high for this statistic was previously 27. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that WMS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 25 hedge funds in our database with WMS positions at the end of the fourth quarter.

At the moment there are many indicators stock market investors employ to assess publicly traded companies. A couple of the less known indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top fund managers can beat the S&P 500 by a very impressive margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Peter Rathjens of Arrowstreet Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to check out the new hedge fund action surrounding Advanced Drainage Systems Inc. (NYSE:WMS).

Do Hedge Funds Think WMS Is A Good Stock To Buy Now?

At Q1’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 16% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WMS over the last 23 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Select Equity Group, managed by Robert Joseph Caruso, holds the largest position in Advanced Drainage Systems Inc. (NYSE:WMS). Select Equity Group has a $359 million position in the stock, comprising 1.3% of its 13F portfolio. Coming in second is Sharlyn C. Heslam of Stockbridge Partners, with a $322.8 million position; 7.9% of its 13F portfolio is allocated to the company. Other members of the smart money that hold long positions contain Ian Simm’s Impax Asset Management, Ken Griffin’s Citadel Investment Group and Richard Merage’s MIG Capital. In terms of the portfolio weights assigned to each position Stockbridge Partners allocated the biggest weight to Advanced Drainage Systems Inc. (NYSE:WMS), around 7.86% of its 13F portfolio. MIG Capital is also relatively very bullish on the stock, setting aside 4.98 percent of its 13F equity portfolio to WMS.

As one would reasonably expect, key money managers have been driving this bullishness. Millennium Management, managed by Israel Englander, established the biggest position in Advanced Drainage Systems Inc. (NYSE:WMS). Millennium Management had $23.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $12.2 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Michael Gelband’s ExodusPoint Capital, and Lee Ainslie’s Maverick Capital.

Let’s now review hedge fund activity in other stocks similar to Advanced Drainage Systems Inc. (NYSE:WMS). These stocks are BRP Inc. (NASDAQ:DOOO), Euronet Worldwide, Inc. (NASDAQ:EEFT), Targa Resources Corp (NYSE:TRGP), Virgin Galactic Holdings, Inc. (NYSE:SPCE), Tripadvisor Inc (NASDAQ:TRIP), Phillips 66 Partners LP (NYSE:PSXP), and Proofpoint Inc (NASDAQ:PFPT). This group of stocks’ market values resemble WMS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DOOO | 17 | 196834 | 2 |

| EEFT | 40 | 511517 | 8 |

| TRGP | 24 | 531977 | -5 |

| SPCE | 17 | 210974 | -6 |

| TRIP | 45 | 1975906 | 4 |

| PSXP | 5 | 45200 | 1 |

| PFPT | 22 | 455170 | -4 |

| Average | 24.3 | 561083 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.3 hedge funds with bullish positions and the average amount invested in these stocks was $561 million. That figure was $1221 million in WMS’s case. Tripadvisor Inc (NASDAQ:TRIP) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 5 bullish hedge fund positions. Advanced Drainage Systems Inc. (NYSE:WMS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for WMS is 69. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.8% in 2021 through July 2nd and still beat the market by 6 percentage points. Hedge funds were also right about betting on WMS, though not to the same extent, as the stock returned 11.8% since Q1 (through July 2nd) and outperformed the market as well.

Follow Advanced Drainage Systems Inc. (NYSE:WMS)

Follow Advanced Drainage Systems Inc. (NYSE:WMS)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Software Stocks to Buy According to Billionaire Paul Tudor Jones

- 13 Most Influential Women To Watch in 2021

Disclosure: None. This article was originally published at Insider Monkey.