With the markets edging up on Friday as investors anticipate the Fed delaying a rate hike until next year, some stocks are losing ground on the back of negative news. For example, the stocks of Schlumberger Limited. (NYSE:SLB) and W W Grainger Inc (NYSE:GWW) are down by 4% and 6% respectively, after the companies reported worse-than-expected financial results, while shares of Genworth Financial Inc (NYSE:GNW) are trading nearly 9% lower after its CFO announced his resignation. In this article we will discuss the news that sent these three, as well as two other stocks, lower Friday, and will assess the hedge fund sentiment in order to see if the smart money investors are betting on the long-term prospects of these companies.

Rawpixel / shutterstock.com

Most news that is related to individual companies has short-term effects and often the market overreacts to the news without seeing the big picture. One of the easiest ways to avoid going with the crowd in the wrong direction is to look at what hedge funds think about a particular company. At Insider Monkey we track over 700 hedge funds and by looking at which stocks they prefer to invest their money in, we can identify many trading opportunities. However, we focus on small-cap stocks because our research showed that they can generate the highest returns for a retail investor. Our strategy involves imitating the 15 most popular small-cap picks among the funds we track and it has returned 102% since August 2012, beating the S&P 500 ETF (SPY) by some 53 percentage points (see details here).

Genworth Financial Inc (NYSE:GNW) was down on Friday after its CFO Martin Klein resigned to take a role at another company. Kelly Groh will replace Klein, having been promoted from the position of controller and principal accounting officer. The stock declined amid concerns from investors regarding the company’s outlook, since Klein had been working on improving controls. In March, Genworth Financial Inc (NYSE:GNW) said it had disclosed a “material weakness” in its internal controls regarding some financial reporting related to its long-term care insurance unit and Klein had been addressing that issue. Still, despite the stock’s 41% drop since the beginning of the year, the smart money has been bullish on the company through the middle of the year, since 37 funds from our database reported stakes equal to over 12% of the company’s shares at the end of June. Moreover, the number of funds with long positions appreciated by eight during the second quarter, while the total value of their holdings went up to $471.31 million. Moreover, all top seven investors of Genworth Financial Inc (NYSE:GNW) from our database increased their positions during the quarter. ClearBridge held the largest stake at the end of June, of 9.34 million shares, up by 3%.

Follow Genworth Financial Inc (NYSE:GNW)

Follow Genworth Financial Inc (NYSE:GNW)

Receive real-time insider trading and news alerts

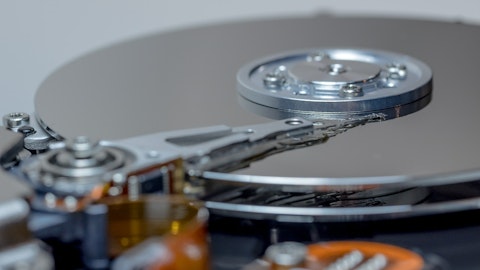

Then there is Seagate Technology PLC (NASDAQ:STX), whose stock extended its fall of 14% yesterday by losing another 7% today on the back of preliminary financial results which were lower than previously anticipated (see details here). Earlier today, Craig Hallum downgraded Seagate Technology PLC (NASDAQ:STX)’s stock to ‘Hold’ from ‘Buy’ and lowered its price target to $48 from $62, although yesterday, two other analysts, Brean Capital and RBC Capital, reiterated their ‘Buy’ ratings, while Needham & Company LLC downgraded the stock to ‘Buy’ from ‘Strong Buy’ and cut its price target to $50 from $65.

Follow Seagate Technology Holdings Plc (NASDAQ:STX)

Follow Seagate Technology Holdings Plc (NASDAQ:STX)

Receive real-time insider trading and news alerts

On the next page, we will discuss three companies that provided their financial results for the most recent quarter.