U.S stocks are trading down ever so slightly on this fine Friday afternoon. Even though oil prices are plummeting ahead of the Doha oil producers’ meeting this weekend, better-than-feared financial results released by several companies have helped contain the market’s losses. However, as usual, stocks are moving in both directions today and in this article we’ll look at five of them that are making some of the biggest moves in either direction. Those stocks are Great Basin Scientific Inc (NASDAQ:GBSN), BATS Global Markets, Inc. Class A Common Stock (BATS:BATS), Infosys Ltd ADR (NYSE:INFY), Regulus Therapeutics Inc (NASDAQ:RGLS), and Stratasys, Ltd. (NASDAQ:SSYS), all of which are posting considerable oscillations in Friday trading. Let’s dig into what is causing these moves and see top hedge funds think about these companies.

Our research has shown that the best strategy is to follow hedge funds into their small-cap picks. This approach can allow monthly returns of nearly 95 basis points above the market, as we determined through extensive backtests covering the period between 1999 and 2012 (see the details here).

Shares of Nano-Cap Flirting With Triple-Digit Gains

Let’s start with one of Friday’s biggest movers: Great Basin Scientific Inc (NASDAQ:GBSN). The nano-cap molecular diagnostic testing company is trading up by almost 88% on Friday afternoon, driven by the announcement of its preliminary first quarter financial results. On Thursday afternoon, management said the company saw first quarter revenue of $731,422, up by 59.4% year-over-year, and 119.8% customer growth.

Being a nano-cap, Great Basin Scientific Inc (NASDAQ:GBSN) does not count the support of many institutional investors. At the end of the fourth quarter of 2015, only nine investment firms that we track (which filed 13Fs for the period) were long the stock.

Follow Great Basin Scientific Inc. (NASDAQ:GBSN)

Follow Great Basin Scientific Inc. (NASDAQ:GBSN)

Receive real-time insider trading and news alerts

Stock Exchange Operator Sees Its Own Stock Soar

Next up is BATS Global Markets, Inc. Class A Common Stock (BATS:BATS), the second-largest stock exchange operator in the U.S by volume, which is up by more than 20.5% today on its first day of trading. The company priced its initial public offering at $19 per share, at the high end of its range and shares are already trading close to $23, with 11.6 million shares trading hands so far today.

The BATS Global Markets, Inc. Class A Common Stock (BATS:BATS) IPO was the largest so far this year, and some investors believe it could revitalize the IPO market, which has been quite slow in 2016. Other interesting facts related to the stock include that back in 2012, BATS tried to go public but failed due to an embarrassing (to say the least) technology glitch; embarrassing, because BATS is an acronym for “better alternative trading system.”

Follow Bats Global Markets Inc. (LON:BATS)

Follow Bats Global Markets Inc. (LON:BATS)

Receive real-time insider trading and news alerts

We have the skinny on three more stocks making waves today on the next page.

Infosys Jumps on Strong Revenue, Guidance

Shares of Infosys Ltd ADR (NYSE:INFY) are up by more than 8.75% this afternoon after the release of the company’s fourth quarter of fiscal year 2016 financial results on Thursday afternoon. The results show that the IT services provider pulled in EPS of $0.23, in-line with estimates, on revenue of $2.45 billion, up by 13.4% year-over-year and $20 million above consensus expectations. Guidance was also strong: management expects revenue to grow by 11.5%-to-13.5% in constant currency terms for the 2017 fiscal year.

By the end of the fourth quarter, 21 funds among those we track were long Infosys Ltd ADR (NYSE:INFY). The largest stake was held by Ken Fisher’s Fisher Asset Management, which disclosed ownership of 21.9 million shares worth roughly $366 million as of December 31.

Interim Phase II Study Data Sends Regulus Down

On the other hand, there’s Regulus Therapeutics Inc (NASDAQ:RGLS), which is down by more than 13% this afternoon following the announcement of interim data from Phase 2 studies for RG-101 for the treatment of chronic hepatitis C virus (HCV) infection. While the market was punishing the stock on the back of the published results, analysts were defending the company. Wedbush analysts assured that the interim results had reached primary endpoints, while Cowen’s Eric Schmidt argued that “Additional RG-101 Phase II Data Continues To Look Solid.”

13 funds among those in our database held long positions in Regulus Therapeutics Inc (NASDAQ:RGLS) at the end of 2015, with their stakes accounting for more than 10% of the company’s shares. RA Capital Management, a healthcare fund managed by Peter Kolchinsky, declared holding 3.48 million Regulus shares as of the end of 2015.

Follow Regulus Therapeutics Inc. (NASDAQ:RGLS)

Follow Regulus Therapeutics Inc. (NASDAQ:RGLS)

Receive real-time insider trading and news alerts

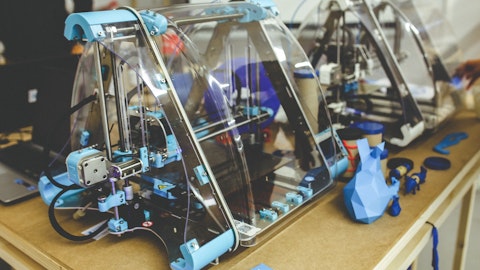

Stratasys Gives Back Yesterday’s Gains After Downgrade

Finally, there’s Stratasys, Ltd. (NASDAQ:SSYS), which is down by almost 11% today after Citi analyst Kenneth Wong shared a bearish update on the 3D printing market. The expert downgraded Stratasys to ‘Neutral’ on ‘Buy’ on limited near-term upside potential, arguing that he believes “good enough results” won’t be sufficient “with the recent boost in sentiment, and with industry checks still soft.” The firm issued a $30 price target on the stock, which now represents 15% upside given its struggles today. The downgrade comes just a day after Stratasys jumped on positive sentiment for the 3D printing industry after 3D Systems Corporation (NYSE:DDD) was upgraded to ‘Buy’ by Bank of America Merrill Lynch. 3D Systems has also retreated today, down by 6%.

At the end of 2015, 17 funds among those that we track were long Stratasys, Ltd. (NASDAQ:SSYS), with the largest stake, amounting to 2.1 million shares, being held by Ken Fisher’s Fisher Asset Management.

Follow Stratasys Inc (NASDAQ:SSYS)

Follow Stratasys Inc (NASDAQ:SSYS)

Receive real-time insider trading and news alerts

Disclosure: Javier Hasse holds no positions in any of the securities mentioned in this article.