If you’re not up on what Tesla Motors Inc (NASDAQ:TSLA) is doing, you might want to rethink your priorities. For a company with an automotive lineup consisting of just two cars, it has major long-term potential. Let’s take a look at why Tesla should think, or is already thinking, about making a truck. Yes! A truck!

A feature of electric motors

One technical component to think about when considering electric vehicles like Tesla Motors Inc (NASDAQ:TSLA)’s is tourque. Torque is the ability to create massive force through the wheels of a machine. When it comes to electric cars, torque rules. It’s more powerful in electric engines than gasoline and thus more efficient for the pushing and pulling that trucks are often asked to do.

Even if Tesla Motors Inc (NASDAQ:TSLA) does not want to build a truck under its own brand, it should think about creating an offshoot to do so. Or, perhaps it could license its own technology to some other company that might build a truck. One problem: the truck market is already a pretty crowded place.

Trucks are popular products

Last year, sales of trucks were up for all automakers, with the exception of General Motors Company (NYSE:GM), which saw a 0.3% decrease in sales.

Source: CNBC

An improved housing market along with growth in the domestic energy sector is boosting truck sales, reports The New York Times. Given this environment, Tesla Motors Inc (NASDAQ:TSLA) might be well timed to enter the truck market. The problem is that it takes a lot of time and effort to build a vehicle from scratch. Tesla’s first car, the Roadster, shares a lot of components with a Lotus Elise because of these challenges.

In the beginning, Tesla Motors Inc (NASDAQ:TSLA) was just trying to perfect its electric motor and battery systems. Now that it has found a design good enough for mass production, it’s building cars of its own complete design. The plan to build the Model X sport-utility vehicle is a testament to this.

A big premium

Trucks have the highest premium prices and as a result offer the best margins on automobiles in the United States. The reason why Ford Motor Company (NYSE:F) makes money despite gigantic ($30-billion plus) quarterly operating expenses is because of the nice margins it gets from trucks. The Wall Street Journal reported earlier this year that Ford Motor Company (NYSE:F) makes a hefty 10% off of the retail price of its F-Series trucks.

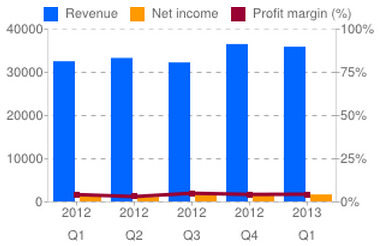

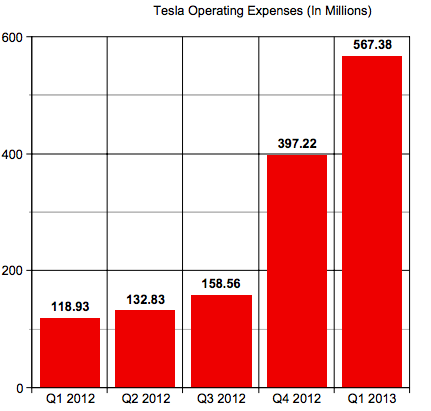

Source: Google Finance

Tesla Motors Inc (NASDAQ:TSLA)’s operating expenses have jumped dramatically, which suggests continued investment in its vehicle systems. Vertically integrated, the company has potential to control more of its supply chain than the likes of GM and Ford. This, in effect, can insulate the company from issues that might emanate from its supplier chain.

Source: Google Finance Data

The add-on costs of a truck

As electric vehicles become mainstream, auto buyers are more conscious of the cost of fuel. Despite the natural-gas boom in the United States, regular gasoline prices are still rising. Alternative-fuel vehicles, especially in the truck market, offer a value proposition when you consider the added expense. It’s not unreasonable for a truck owner to spend $100 filling up their vehicle.

Source: AAA

Household gasoline spending is up, according to the AAA, and the biggest gas-guzzlers are by far full-sized trucks. It has been reported that Ford is thinking about building hybrid trucks, which would reduce fuel consumption and help the company meet government fuel-standard requirements, which dictates that full- sized trucks meet 30 MPG standards by 2025.

With that type of fuel efficiency required within the next 12 years, it’s easy to see why Ford Motor Company (NYSE:F) wants to build a hybrid. But one has to wonder why General Motors Company (NYSE:GM) quietly has stopped producing a lineup of hybrid trucks. GM recently said that “there wasn’t enough volume to justify the investment,” in its hybrid models.

Two out of three

This type of mentality from GM is why little has changed despite the massive upheaval the company has experienced over the past decade. Instead of continuing to invest in hybrids, it has decided to switch focus. The company has been pouring money into China. But that’s coming at a time when debt problems there are becoming real.

GM just makes too many mistakes to dictate it being a sound investment. It reported an operating income loss of over $30 billion in 2012. In the first quarter of 2013, the story was repeated not even at a multiple: a larger than $30 billion operating gap.

Ford seems to make less baffling decisions. Unlike General Motors Company (NYSE:GM), the company has been able to operate on financially sound principles for some time. It also makes a ton of money on trucks – more than anyone else. Ford has not done significant investing in China, a market it honestly knows it doesn’t understand.

If you believe in the turnaround of a U.S. economy that is showing signs of life, then now is a good time to buy some Ford stock. And even though its operating expenses have gone up in the past year, to $35 billion in the most recent quarter, the company has been able to keep income up, which shows discipline for a large company.

Tesla Motors Inc (NASDAQ:TSLA) faces a number of challenges in the automotive market. Yet we have seen that it is willing to do unconventional things in order to be successful. While it continued to pile up operating losses to the tune of $394 million last year, $273 million of that went into research and development. Tesla is squeaking out a small profit now, which is good. As it continues to develop its lineup of products, it should perform quite well as an investment. Especially if it ends up developing a truck for the U.S. market.

The article What Would Happen If Tesla Built a Truck? originally appeared on Fool.com and is written by Daniel Cawrey.

Daniel Cawrey has no position in any stocks mentioned. The Motley Fool recommends Ford, General Motors, and Tesla Motors. The Motley Fool owns shares of Ford and Tesla Motors. Daniel is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.