The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Qorvo Inc (NASDAQ:QRVO).

Qorvo Inc (NASDAQ:QRVO)’s investors should be aware of an increase in hedge fund interest of late. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as HD Supply Holdings Inc (NASDAQ:HDS), KT Corporation (ADR) (NYSE:KT), and Raymond James Financial, Inc. (NYSE:RJF) to gather more data points.

Follow Qorvo Inc. (NASDAQ:QRVO)

Follow Qorvo Inc. (NASDAQ:QRVO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Rolf E. Staerk / Shutterstock.com

Keeping this in mind, we’re going to take a gander at the key action surrounding Qorvo Inc (NASDAQ:QRVO).

Hedge fund activity in Qorvo Inc (NASDAQ:QRVO)

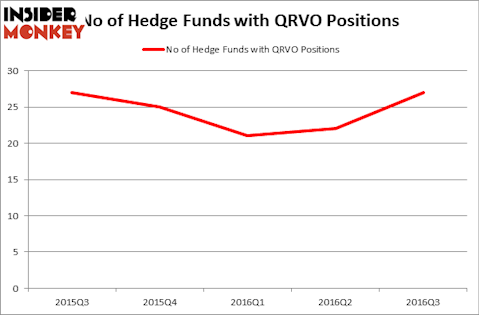

During the third quarter, the number of hedge funds tracked by Insider Monkey that held long positions in Qorvo advanced by 23% to 27. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Fisher’s Fisher Asset Management holds the largest position in Qorvo Inc (NASDAQ:QRVO). Fisher Asset Management has a $63.6 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Gruss Asset Management, led by Howard Guberman, holding a $24.5 million call position; 0.7% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that hold long positions encompass Richard Barrera’s Roystone Capital Partners, Curtis Macnguyen’s Ivory Capital (Investment Mgmt), and Ken Griffin’s Citadel Investment Group.

As aggregate interest increased, specific money managers were breaking ground themselves. Curtis Macnguyen’s Ivory Capital (Investment Mgmt) initiated a $12.5 million position during the quarter. Two other funds with new positions in the stock are Solomon Kumin’s Folger Hill Asset Management and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Qorvo Inc (NASDAQ:QRVO) but similarly valued. We will take a look at HD Supply Holdings Inc (NASDAQ:HDS), KT Corporation (ADR) (NYSE:KT), Raymond James Financial, Inc. (NYSE:RJF), and Kohl’s Corporation (NYSE:KSS). All of these stocks’ market caps match QRVO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HDS | 40 | 1866259 | -7 |

| KT | 10 | 93403 | 2 |

| RJF | 17 | 329488 | 1 |

| KSS | 29 | 409994 | 1 |

As you can see these stocks had an average of 24 funds with bullish positions and the average amount invested in these stocks was $675 million, versus $198 million in QRVO’s case. HD Supply Holdings Inc (NASDAQ:HDS) is the most popular stock in this table. On the other hand KT Corporation (ADR) (NYSE:KT) is the least popular one with only 10 bullish hedge fund positions. Qorvo Inc (NASDAQ:QRVO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HD Supply Holdings Inc (NASDAQ:HDS) might be a better candidate to consider a long position.