Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Comcast Corporation (NASDAQ:CMCSA) based on that data.

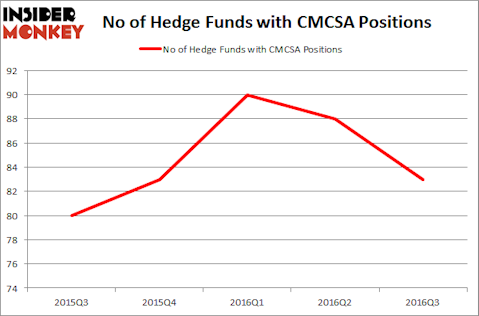

Comcast Corporation (NASDAQ:CMCSA) has experienced a decrease in hedge fund sentiment recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Philip Morris International Inc. (NYSE:PM), Medtronic, Inc. (NYSE:MDT), and Intel Corporation (NASDAQ:INTC) to gather more data points.

Follow Comcast Corp (NASDAQ:CMCSA)

Follow Comcast Corp (NASDAQ:CMCSA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Jonathan Weiss / Shutterstock.com

With all of this in mind, we’re going to take a peek at the recent action surrounding Comcast Corporation (NASDAQ:CMCSA).

What does the smart money think about Comcast Corporation (NASDAQ:CMCSA)?

A total of 83 funds tracked by Insider Monkey held long positions in this stock at the end of September, down by five funds over the quarter. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Lansdowne Partners, managed by Alex Snow, holds the most valuable position in Comcast Corporation (NASDAQ:CMCSA). Lansdowne Partners has a $1.59 billion position in the stock, comprising 13.7% of its 13F portfolio. Sitting at the No. 2 spot is Ken Fisher of Fisher Asset Management, with a $826.8 million position; 1.5% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism consist of John Armitage’s Egerton Capital Limited, Ken Griffin’s Citadel Investment Group, and Eric W. Mandelblatt’s Soroban Capital Partners.

Seeing as Comcast Corporation (NASDAQ:CMCSA) has experienced bearish sentiment from hedge fund managers, we can see that there were a few hedge funds that slashed their positions entirely in the third quarter. At the top of the heap, Jean-Marie Eveillard’s First Eagle Investment Management sold off the biggest position of all the hedgies tracked by Insider Monkey, totaling about $1.71 billion in stock. James Crichton’s fund, Hitchwood Capital Management, also dropped its stock, about $176 million worth.

Let’s check out hedge fund activity in other stocks similar to Comcast Corporation (NASDAQ:CMCSA). We will take a look at Philip Morris International Inc. (NYSE:PM), Medtronic, Inc. (NYSE:MDT), Intel Corporation (NASDAQ:INTC), and Toyota Motor Corporation (ADR) (NYSE:TM). This group of stocks’ market caps resemble CMCSA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PM | 45 | 4516843 | -2 |

| MDT | 43 | 1294020 | -7 |

| INTC | 68 | 4883403 | 11 |

| TM | 12 | 300189 | -1 |

As you can see these stocks had an average of 42 hedge funds with bullish positions and the average amount invested in these stocks was $2.75 billion. That figure was $8.16 billion in Comcast’s case. Intel Corporation (NASDAQ:INTC) is the most popular stock in this table with 68 funds holding long positions. On the other hand, Toyota Motor Corporation (ADR) (NYSE:TM) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Comcast Corporation (NASDAQ:CMCSA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.