The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Belden Inc. (NYSE:BDC) from the perspective of those successful funds.

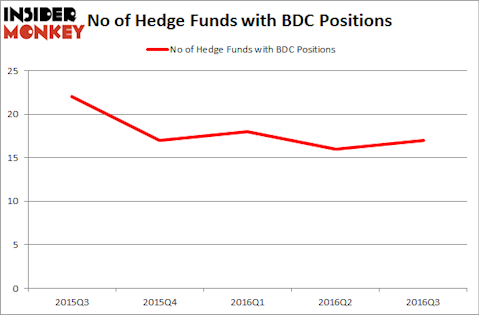

Is Belden Inc. (NYSE:BDC) a safe investment right now? The smart money is buying. During the third quarter, the number of bullish hedge fund bets inched up by one to 16. At the end of this article we will also compare BDC to other stocks including Five Below Inc (NASDAQ:FIVE), Brinker International, Inc. (NYSE:EAT), and Papa John’s Int’l, Inc. (NASDAQ:PZZA) to get a better sense of its popularity.

Follow Belden Inc. (NYSE:BDC)

Follow Belden Inc. (NYSE:BDC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

hin255/Shutterstock.com

Keeping this in mind, we’re going to take a look at the recent action encompassing Belden Inc. (NYSE:BDC).

What have hedge funds been doing with Belden Inc. (NYSE:BDC)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 6% from the previous quarter. By comparison, also 17 hedge funds held shares or bullish call options in BDC heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Matthew Lindenbaum’s Basswood Capital has the most valuable position in Belden Inc. (NYSE:BDC), worth close to $45.9 million, accounting for 2.2% of its total 13F portfolio. On Basswood Capital’s heels is Cliff Asness’ AQR Capital Management, with a $12.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism comprise Jim Simons’ Renaissance Technologies, Israel Englander’s Millennium Management, and Joel Greenblatt’s Gotham Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-microcap stocks.