At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Berkshire Hills Bancorp, Inc. (NYSE:BHLB) undervalued? Money managers are categorically in an optimistic mood. The number of long hedge fund bets grew by 2 lately. At the end of this article we will also compare BHLB to other stocks including First Busey Corporation (NASDAQ:BUSE), Liberty Braves Group (NASDAQ:BATRK), and Global Blood Therapeutics Inc (NASDAQ:GBT) to get a better sense of its popularity.

Follow Beacon Financial Corp (NYSE:BBT)

Follow Beacon Financial Corp (NYSE:BBT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Francisco Amaral Leitao / shutterstock.com

Hedge fund activity in Berkshire Hills Bancorp, Inc. (NYSE:BHLB)

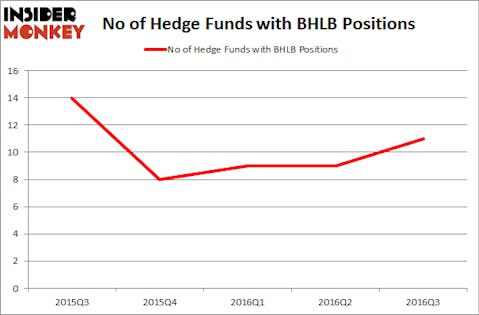

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 22% increase from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in BHLB over the last 5 quarters, which shows a slight rebound since a big drop in ownership in Q4 2015. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management, one of the 10 largest hedge funds in the world, holds the most valuable position in Berkshire Hills Bancorp, Inc. (NYSE:BHLB). Millennium Management has a $14.1 million position in the stock. The second most bullish fund is Jim Simons’ Renaissance Technologies, with an $8.5 million position. Some other professional money managers that hold long positions comprise David E. Shaw’s D E Shaw, Emanuel J. Friedman’s EJF Capital, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.