As investors woke up after the day of the Presidential election, seemingly nothing had changed. The incumbent President, Barack Obama, stayed in office, the GOP maintained leadership of the House of Representatives while Democrats controlled the Senate. Does that mean four more years of partisan gridlock? No way. The stakes are now so much higher, for one simple reason: At the end of 2008, total government debt stood at $10.7 trillion. Nowadays, that figures exceeds $16 trillion.

[Read: “Warning: Here’s How the ‘Fiscal Cliff’ Could Ruin Your Portfolio“]

Frankly, these legislators have little idea how bad things will be if they once again kick the can down the road. Consider that annual interest on our national debt barely budged under the first Obama term, from $451 billion in 2008 to roughly $460 billion this year. Ultra-low interest rates get the credit. Yet it’s foolish to assume that rates will stay at historical lows over the next four years, and any delays in tackling the problem could lead to a surge in interest expense when rates start to rebound.

The end of 10-1?

Closed-door discussions in 2011 between President Obama and House Speaker John Boehner were said to focus on an agreement that enacted $1 in tax increases for every $10 in spending cuts. This alleged plan was eventually rejected by all Republican candidates in this year’s primaries as any newtaxes were anathema.

Now, the Obama Administration may not even be willing to offer a 10-1 cuts-to-taxes ratio and might use something closer to 5-to-1 as a starting negotiating point.

The industry outlook

If Congress is ultimately responsible for crafting legislation, then President Obama can at least steer the discussion by pushing for certain priorities. I recently took a look at what the administration’s policies might mean for individuals on our sister site, InvestingAnswers.com. Here’s a closer look at what he would like to accomplish in terms of business and industry — and how that might affect how you invest.

Drillers and miners: a revamp of leases

As he no longer needs to worry about the next campaign, President Obama is likely to pursue changes more aggressively in key industries that he has targeted in the past. For example, mining and energy companies will be pressed to pay higher lease fees on any government lands that they exploit.

Energy analysts are also watching the national “fracking” debate, which has thus far only been assessed at a statewide level. The federal government is likely to weigh in with nationwide rules that spell out what chemicals can be used, and required levels of drilling site remediation.

That should help boost demand for environmental services firms in this area. Schlumberger Limited. (NYSE:SLB), for example, offers a fracking fluid that while pricier, is more environmentally benign. Smaller companies such as Heckmann Corporation (NYSE:HEK), which provides water treatment services to frackers, should also see strong demand.

Yet the oil and gas industry has reason for optimism. Environmental concerns over the Keystone pipeline have been fully digested, and the long-delayed expansion will likely move forward. And by the end of President Obama’s current term, the U.S. is likely to become a natural gas export powerhouse, thanks to a series of liquid natural gas (LNG) facilities that are currently being built along the U.S. Gulf Coast.

A focus on manufacturing

In keeping with stated aims to bolster opportunities for middle class workers, look for President Obama to make a greater push for job creation in manufacturing. That could mean a series of tax credits for firms that repatriate jobs that had been outsourced.

In his first term, President Obama spoke of the need to sharply boost U.S. exports, though flagging demand in Europe and elsewhere in recent years has made that a tough sell. Trade flows, especially with countries like China, are likely to remain a key focus for the administration.

The health care course correction

Many businesses remain concerned about the looming mandates associated with health care reform. How the ambitious plan will play out is still an open question. More than likely, the Affordable Health Care Act (aka Obamacare) will need to be modified as facts on the ground start to clash with the theoretical assumptions that had been made. Extensive models that imply myriad cost-saving moves have yet to be fully implemented in the real world.

The fact that many healthcare insurers such as Humana Inc. (NYSE:HUM) trade at very low levels relative to their cash balances tells you that investors are anticipating more changes to come. This is a sector to track closely. Ongoing changes in healthcare will continue to create new groups of winners and losers.

You can use a simple rule of thumb to find winners: Any company that provides goods or services that improve patient outcomes at a lower cost are sure to find favor. Conversely, high-priced drugs could be supplanted by lower-cost, equally effective drugs, and pricey medical devices will come under ever-greater scrutiny — especially if a lower-priced product comes along.

Uncertainty morphs into certainty

President Obama is well aware of the current tepid state of economic growth, which is partially attributable to lingering uncertainty in corporate America. From the looming “Fiscal Cliff” to further regulatory changes that may affect certain industries, many companies have become hesitant to invest in major growth initiatives. As a result, look for a move to quickly resolve the Fiscal Cliff and an early articulation of key policy goals. The Obama administration knows that a higher level of certainty about government policy in the years ahead could finally propel companies to start spending.

The Supreme Court

In recent years, the Supreme Court has evidenced a pro-business tilt on a range of issues. At this point, it is unclear if Justices Scalia, Alito, Thomas, Roberts or Kennedy have plans to retire in the next four years (Kennedy is the oldest at 76), but if that happens, then President Obama would be able to put a new Justices on the Supreme Court who might not be seen as business-friendly. A similar trend could play out on lower federal courts.

Risks to Consider: The past four years have been characterized by many problems and little progress. Gridlock, in some respects, has been at an all-time high. Further gridlock could prove to be disastrous.

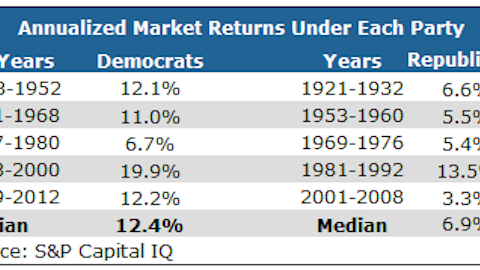

Action to Take –> Keep a close eye on the stances of each party’s political leadership. Each side is drawing fresh lines in the sand to establish initial negotiating positions as we get our budget gap under control. How quickly both sides can nudge toward the center will have a huge effect on the economy — and the stock market. Simply put, the stock and bond markets will no longer tolerate inaction as the national debt clock spirals ever higher.

As I’ve noted many times in the past, get ready for higher taxes and a smaller government. The budget math shows no other route. On the one hand, the stock and bond markets would cheer a credible path to debt reduction. But such a move creates a fiscal drag as the government stops providing deficit-fueled stimulus to the economy.

This article was originally written by David Sterman, and posted on StreetAuthority.