ClearBridge Investments, an investment management company, released its “ClearBridge Small Cap Growth Strategy” first quarter 2025 investor letter. A copy of the letter can be downloaded here. The stock market performance in the first quarter of 2025 was volatile, following the initial “animal spirits” post-election rally. The strategy surpassed its benchmark with the support of new ideas, reorienting efforts, and tailwinds in several industries despite volatility and uncertainty. Given the pace of major policy changes, the firm expects ongoing volatility as the effects of tariffs and policymaking have clouded visibility. In addition, please check the fund’s top five holdings to know its best picks in 2025.

In its first quarter 2025 investor letter, ClearBridge Small Cap Growth Strategy emphasized stocks such as Glaukos Corporation (NYSE:GKOS). Glaukos Corporation (NYSE:GKOS) is an ophthalmic pharmaceutical and medical technology company. The one-month return of Glaukos Corporation (NYSE:GKOS) was -11.98%, and its shares lost 15.04% of their value over the last 52 weeks. On April 7, 2025, Glaukos Corporation (NYSE:GKOS) stock closed at $86.07 per share with a market capitalization of $4.869 billion.

ClearBridge Small Cap Growth Strategy stated the following regarding Glaukos Corporation (NYSE:GKOS) in its Q1 2025 investor letter:

“We continued to generate a number of compelling new ideas, adding five new investments that we still held at quarter end: Glaukos Corporation (NYSE:GKOS), Rocket Lab USA, Karman Holdings (through its IPO), Archrock, Hims & Hers and Geron.

Glaukos is a medical device company focused primarily on treating ophthalmological conditions such as glaucoma and corneal health. With several commercialized products and an innovative track record, the company is in the process of launching a potential blockbuster product, iDose, which is a drug device combination with a variety of administration/efficacy advantages in treating glaucoma.”

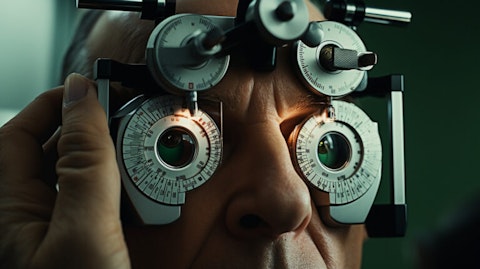

A doctor examining a patient’s eyes with an ophthalmic medical device.

Glaukos Corporation (NYSE:GKOS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 30 hedge fund portfolios held Glaukos Corporation (NYSE:GKOS) at the end of the fourth quarter compared to 32 in the third quarter. In 2024, Glaukos Corporation’s (NYSE:GKOS) consolidated net sales grew 22% year over year to $383.5 million. While we acknowledge the potential of Glaukos Corporation (NYSE:GKOS) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

We covered Glaukos Corporation (NYSE:GKOS) in another article, where we shared the list of best medical technology stocks to buy according to analysts. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.