Greystone Capital Management, an investment management company, released its second-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the second quarter, the return for separate accounts managed by the firm ranged from +4.3 to +7.1%. The median account returned +6.0% net of fees. Q2 and YTD results were unfavorably and favorably compared to the +4.3% and -3.3% during the quarter and +15.2% and +1.7% year-to-date returns for the S&P 500 and Russell 2000. The fund’s return generally varies from the major indices as the fund’s portfolio concentrates on small companies outside the major indices. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2024.

Greystone Capital Management highlighted stocks like Bel Fuse Inc. (NASDAQ:BELFB) in its Q2 2024 investor letter. Bel Fuse Inc. (NASDAQ:BELFB) designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits. The one-month return of Bel Fuse Inc. (NASDAQ:BELFB) was 15.51%, and its shares gained 39.89% of their value over the last 52 weeks. On July 26, 2024, Bel Fuse Inc. (NASDAQ:BELFB) stock closed at $75.05 per share with a market capitalization of $980.513 million.

Greystone Capital Management stated the following regarding Bel Fuse Inc. (NASDAQ:BELFB) in its Q2 2024 investor letter:

“Shares of Bel Fuse Inc. (NASDAQ:BELFB), our electronics component manufacturer, are up slightly for the year, despite industry de-stocking issues expected to impact the company’s top line during FY24. Despite these well-documented issues along with the company’s Magnetics segment still limping along, profitability improvements will remain sticky moving forward, resulting in continued ample cash generation.

In terms of uses for that cash, Bel is entering into new product and market segments, gaining exposure in attractive end markets such as space and data centers, while M&A remains an option to accelerate top line growth. Most importantly, for the first time in the company’s history, Bel Fuse established a share buyback program to the tune of $25mm, which should be exhausted by the end of this year. Given the current valuation, buying back stock with a double-digit cash flow yield is a great investment, and I welcome further reductions in the share count moving forward.

Bel Fuse has earned our trust by communicating openly, changing capital allocation policies to benefit shareholders, and facing bumps in the road with humility. There is a continued path to strong returns here through a return to normalized operating conditions, further cost optimization, new business wins, and working capital improvements. I remain optimistic about what Bel Fuse can accomplish during the next few years.”

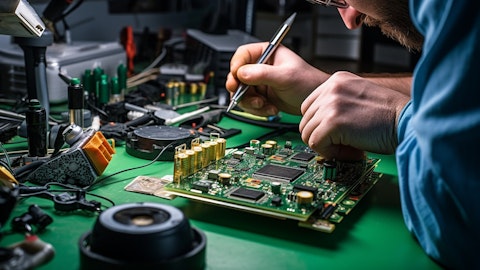

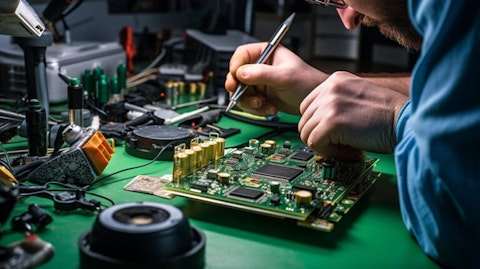

A close-up of a technician’s hands assembling electronic components on a circuit board.

Bel Fuse Inc. (NASDAQ:BELFB) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 17 hedge fund portfolios held Bel Fuse Inc. (NASDAQ:BELFB) at the end of the first quarter which was 16 in the previous quarter. Bel Fuse Inc.’s (NASDAQ:BELFB) second-quarter sales for 2024 totaled $133.2 million, marking a 21.1% decrease from Q2 2023. While we acknowledge the potential of Bel Fuse Inc. (NASDAQ:BELFB) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.