Ensemble Capital Management, an investment management company, released its third quarter 2023 investor letter. A copy of the same can be downloaded here. During the quarter, the strategy declined by 5.68% compared to the S&P 500’s 3.27% decline. The underperformance of the fund was driven by large declines in two holdings that have recently elected activist shareholders to their boards. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Ensemble Capital Management highlighted stocks like Analog Devices, Inc. (NASDAQ:ADI) in the third quarter 2023 investor letter. Headquartered in Wilmington, Massachusetts, Analog Devices, Inc. (NASDAQ:ADI) is a semiconductor company that designs and manufactures integrated circuits (ICs), software, and subsystems. On October 31, 2023, Analog Devices, Inc. (NASDAQ:ADI) stock closed at $157.33 per share. One-month return of Analog Devices, Inc. (NASDAQ:ADI) was -9.47%, and its shares gained 11.39% of their value over the last 52 weeks. Analog Devices, Inc. (NASDAQ:ADI) has a market capitalization of $78.4 billion.

Ensemble Capital Management made the following comment about Analog Devices, Inc. (NASDAQ:ADI) in its Q3 2023 investor letter:

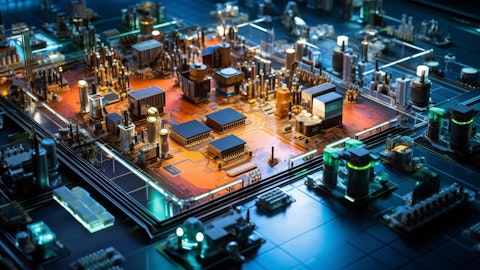

Analog Devices, Inc. (NASDAQ:ADI): Analog Devices, known in the industry as ADI, makes semiconductor chips that predominantly operate at the boundary of the physical world and the digital world, more commonly referred to as analog and mixed signal chips. These chips usually play a supporting role to the sexier “digital brain” that is the latest and greatest processor from Nvidia, Intel, AMD, Apple, or Qualcomm. While the digital brains get a lot more media attention, the supporting analog chips are as vital as those big expensive digital processors in driving value in electronic devices, which are becoming ubiquitous and intelligent throughout our lives.

Anything with an on-off switch requires lots of these analog chips if it is going to relay input and output information with the physical world as well as manage the electrical power supply feeding the device. While these analog chips are relatively inexpensive to manufacture and distribute, it takes a long time to design and build a catalog of literally thousands of specific products to create the scale that makes them economically attractive businesses with a reputation of dependability and quality…” (Click here to read the full text)

A close-up of a technician’s hands working on an advanced semiconductor substrate.

Analog Devices, Inc. (NASDAQ:ADI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 65 hedge fund portfolios held Analog Devices, Inc. (NASDAQ:ADI) at the end of second quarter which was 73 in the previous quarter.

We discussed Analog Devices, Inc. (NASDAQ:ADI) in another article and shared the list of cash-rich dividend stocks to buy. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Best Places to Retire in the UK

- 15 Most Powerful Militaries in Asia

- 13 Best ESG Stocks To Buy Now

Disclosure: None. This article is originally published at Insider Monkey.