Aristotle Atlantic Partners, LLC, an investment advisor, released its “Large Cap Growth Strategy” second quarter 2024 investor letter. A copy of the letter can be downloaded here. In the second quarter, Aristotle Atlantic’s Large Cap Growth Strategy delivered 8.77% gross of fees (8.71% net of fees) outperforming the Russell 1000 Growth Index’s return of 8.33%. Security selection led the portfolio to outperform in the quarter. Security selection in Information Technology and Financials contributed the most to relative performance while health care and Industrials detracted. In addition, you can check the top 5 holdings of the fund to know its best picks in 2024.

Aristotle Atlantic Large Cap Growth Strategy highlighted stocks like Analog Devices, Inc. (NASDAQ:ADI) in the second quarter 2024 investor letter. Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. The one-month return of Analog Devices, Inc. (NASDAQ:ADI) was 5.07%, and its shares gained 24.78% of their value over the last 52 weeks. On July 22, 2024, Analog Devices, Inc. (NASDAQ:ADI) stock closed at $240.04 per share with a market capitalization of $119.112 billion.

Aristotle Atlantic Large Cap Growth Strategy stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its Q2 2024 investor letter:

“Analog Devices, Inc. (NASDAQ:ADI) is a global semiconductor leader dedicated to solving customers’ most complex engineering challenges. The company delivers innovations that connect technology to human breakthroughs and play a critical role at the intersection of the physical and digital worlds by providing the building blocks to sense, measure, interpret, connect and power. Analog designs, manufactures, tests and markets a broad portfolio of solutions, including integrated circuits, software and subsystems that leverage high-performance analog, mixed-signal and digital signal processing technologies. Its comprehensive product portfolio, deep domain expertise and advanced manufacturing capabilities extend across high-performance precision and high-speed mixed-signal, power management and processing technologies, including data converters, amplifiers, power management, radio frequency, integrated circuits, edge processors and other sensors. The company’s customers include original equipment manufacturers and customers that build electronic subsystems for integration into larger systems.

We see the company’s analog products providing exposure to high-growth trends, including automotive electrification and driver assistance systems, factory intelligence and automation, the Intelligent Edge, Internet of Things device proliferation, and sustainable energy. We expect the company to return excess free cash flow, benefiting shareholders.”

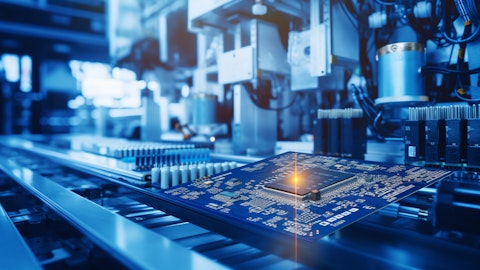

A technician working on power management in a semiconductor factory.

Analog Devices, Inc. (NASDAQ:ADI) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 65 hedge fund portfolios held Analog Devices, Inc. (NASDAQ:ADI) at the end of the first quarter which was 62 in the previous quarter. Analog Devices, Inc. (NASDAQ:ADI) reported second-quarter revenue of $2.16 billion, down 34% year-over-year. While we acknowledge the potential of Analog Devices, Inc. (NASDAQ:ADI) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Analog Devices, Inc. (NASDAQ:ADI) and shared Madison Investors Fund’s views on the company. Ensemble Capital, another investment management company, shared its optimistic outlook on Analog Devices, Inc. (NASDAQ:ADI) in its latest quarterly report. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.