Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” first quarter 2023 investor letter. A copy of the same can be downloaded here. In the first quarter, its Investor Class fund ARTSX returned 7.60%, Advisor Class fund APDSX posted a return of 7.63%, and Institutional Class fund APHSX returned 7.62%, compared to a return of 6.07% for the Russell 2000 Growth Index. Both allocation and security selection drove the portfolio to outperform in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2023.

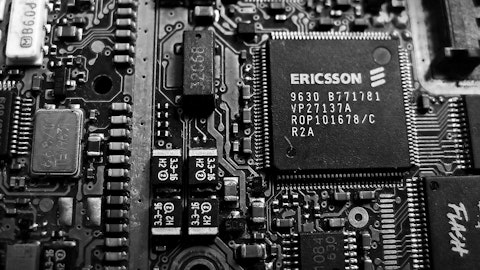

Artisan Small Cap Fund highlighted stocks like Allegro MicroSystems, Inc. (NASDAQ:ALGM) in the first quarter 2023 investor letter. Headquartered in Manchester, New Hampshire, Allegro MicroSystems, Inc. (NASDAQ:ALGM) manufactures sensor integrated circuits (ICs) and application-specific analog power ICs. On May 19, 2023, Allegro MicroSystems, Inc. (NASDAQ:ALGM) stock closed at $38.96 per share. One-month return of Allegro MicroSystems, Inc. (NASDAQ:ALGM) was -5.28%, and its shares gained 60.99% of their value over the last 52 weeks. Allegro MicroSystems, Inc. (NASDAQ:ALGM) has a market capitalization of $7.471 billion.

Artisan Small Cap Fund made the following comment about Allegro MicroSystems, Inc. (NASDAQ:ALGM) in its Q1 2023 investor letter:

“Among our top contributors were Lattice Semiconductor, Monolithic Power Systems, Allegro MicroSystems, Inc. (NASDAQ:ALGM), HubSpot and Wingstop. A strong area of the portfolio was our semiconductor holdings as Lattice Semiconductor, Monolithic Power Systems and Allegro Microsystems each outperformed. This is an area of the market where we have historically found many compelling opportunities, and we believe it continues to be an attractive area for long-term capital. Our high-level thesis is that industry consolidation is driving profitability improvements which, combined with top-line demand growth drivers, are breeding many interesting profit cycles. Please read our latest semiconductor industry whitepaper to dive into our thoughts on the industry. After the strong performance in the quarter, we trimmed Lattice Semiconductor in order to manage the position size and also trimmed Monolithic Power Systems due to the company outgrowing our small-cap mandate.”

Godlikeart/Shutterstock.com

Allegro MicroSystems, Inc. (NASDAQ:ALGM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 15 hedge fund portfolios held Allegro MicroSystems, Inc. (NASDAQ:ALGM) at the end of the fourth quarter which was 18 in the previous quarter.

We discussed Allegro MicroSystems, Inc. (NASDAQ:ALGM) in another article and shared TimesSquare U.S. Small/Mid Cap Growth Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Stocks to Sell in 2023 According to Billionaire Steve Cohen

- 25 Best Places to Live With Lots of Jobs and Cheap Housing

- 10 Least Regulated Industries and Businesses

Disclosure: None. This article is originally published at Insider Monkey.