The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Level 3 Communications, Inc. (NYSE:LVLT) and find out how it is affected by hedge funds’ moves.

Is Level 3 Communications, Inc. (NYSE:LVLT) the right pick for your portfolio? The best stock pickers are categorically taking an optimistic view. The number of bullish hedge fund positions inched up by one last quarter. In this way, LVLT was included in the equity portfolios of 49 funds tracked by Insider Monkey at the end of September. At the end of this article we will also compare LVLT to other stocks including Magna International Inc. (USA) (NYSE:MGA), Western Digital Corp. (NASDAQ:WDC), and T. Rowe Price Group, Inc. (NASDAQ:TROW) to get a better sense of its popularity.

Follow Level 3 Communications Inc (NYSE:LVLT)

Follow Level 3 Communications Inc (NYSE:LVLT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

asharkyu/Shutterstock.com

With all of this in mind, we’re going to go over the recent action encompassing Level 3 Communications, Inc. (NYSE:LVLT).

Hedge fund activity in Level 3 Communications, Inc. (NYSE:LVLT)

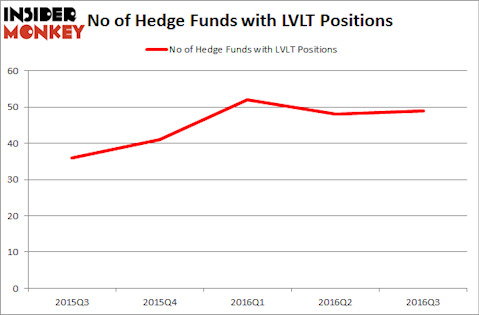

Heading into the fourth quarter of 2016, a total of 49 of the hedge funds tracked by Insider Monkey were long Level 3 Communications, Inc. (NYSE:LVLT), up by 2% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LVLT over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Mason Hawkins’ Southeastern Asset Management has the largest position in Level 3 Communications, Inc. (NYSE:LVLT), worth close to $1.31 billion, corresponding to 12.5% of its total 13F portfolio. On Southeastern Asset Management’s heels is Maverick Capital, led by Lee Ainslie, holding a $259.3 million position; 3.1% of its 13F portfolio is allocated to the company. Some other members of the smart money that are bullish comprise Peter Adam Hochfelder’s Brahman Capital, Kerr Neilson’s Platinum Asset Management, and David E. Shaw’s D E Shaw. We should note that Southeastern Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, specific money managers have jumped into Level 3 Communications, Inc. (NYSE:LVLT) headfirst. Carlson Capital, led by Clint Carlson, established the biggest position in Level 3 Communications, Inc. (NYSE:LVLT). Carlson Capital had $14.5 million invested in the company at the end of the quarter. Jeffrey Bronchick’s Cove Street Capital also made a $7.3 million investment in the stock during the quarter. The following funds were also among the new LVLT investors: Solomon Kumin’s Folger Hill Asset Management, Ken Griffin’s Citadel Investment Group, and George Soros’s Soros Fund Management.

Let’s go over hedge fund activity in other stocks similar to Level 3 Communications, Inc. (NYSE:LVLT). We will take a look at Magna International Inc. (USA) (NYSE:MGA), Western Digital Corp. (NASDAQ:WDC), T. Rowe Price Group, Inc. (NASDAQ:TROW), and Hartford Financial Services Group Inc (NYSE:HIG). This group of stocks’ market values are closest to LVLT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGA | 27 | 435061 | -2 |

| WDC | 51 | 1102808 | 3 |

| TROW | 28 | 534363 | 5 |

| HIG | 37 | 1041662 | 3 |

As you can see these stocks had an average of 36 funds with bullish positions and the average amount invested in these stocks was $778 million. That figure was $2.79 billion in LVLT’s case. Western Digital Corp. (NASDAQ:WDC) is the most popular stock in this table. On the other hand Magna International Inc. (USA) (NYSE:MGA) is the least popular one with only 27 bullish hedge fund positions. Level 3 Communications, Inc. (NYSE:LVLT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Western Digital Corp. (NASDAQ:WDC) might be a better candidate to consider taking a long position in.

Disclosure: none