How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Eaton Corporation, PLC Ordinary Shares (NYSE:ETN).

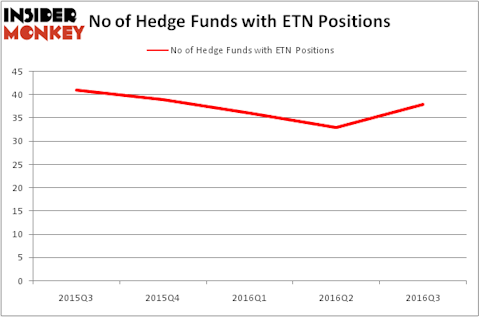

Eaton Corporation, PLC Ordinary Shares (NYSE:ETN) investors should pay attention to an increase in hedge fund interest recently. ETN was in 38 hedge funds’ portfolios at the end of September. There were 33 hedge funds in our database with ETN positions at the end of the previous quarter. At the end of this article we will also compare ETN to other stocks including Aon PLC (NYSE:AON), Twenty-First Century Fox Inc (NASDAQ:FOXA), and Delta Air Lines, Inc. (NYSE:DAL) to get a better sense of its popularity.

Follow Eaton Corp Plc (NYSE:ETN)

Follow Eaton Corp Plc (NYSE:ETN)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Hedge fund activity in Eaton Corporation, PLC Ordinary Shares (NYSE:ETN)

At the end of the third quarter, a total of 38 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 15% rise from one quarter earlier. By comparison, 39 hedge funds held shares or bullish call options in ETN heading into this year, so ownership is still down for the year despite the Q3 rise. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John A. Levin’s Levin Capital Strategies has the number one position in Eaton Corporation, PLC Ordinary Shares (NYSE:ETN), worth close to $154.2 million, accounting for 2.3% of its total 13F portfolio. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $95.3 million position. Other professional money managers with similar optimism encompass Phill Gross and Robert Atchinson’s Adage Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industry-wide interest jumped, specific money managers were leading the bulls’ herd. Millennium Management, led by Israel Englander, assembled the most valuable position in Eaton Corporation, PLC Ordinary Shares (NYSE:ETN). Millennium Management had $36.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $15.4 million position during the quarter. The other funds with brand new ETN positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Andreas Halvorsen’s Viking Global, and Alex Snow’s Lansdowne Partners.

Let’s now review hedge fund activity in other stocks similar to Eaton Corporation, PLC Ordinary Shares (NYSE:ETN). We will take a look at Aon PLC (NYSE:AON), Twenty-First Century Fox Inc (NASDAQ:FOXA), Delta Air Lines, Inc. (NYSE:DAL), and AFLAC Incorporated (NYSE:AFL). All of these stocks’ market caps are closest to ETN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AON | 31 | 2565907 | 0 |

| FOXA | 48 | 3558064 | -1 |

| DAL | 85 | 4967707 | -9 |

| AFL | 29 | 508126 | 2 |

As you can see these stocks had an average of 48 hedge funds with bullish positions and the average amount invested in these stocks was $2.90 billion. That figure was $668 million in ETN’s case. Delta Air Lines, Inc. (NYSE:DAL) is the most popular stock in this table. On the other hand AFLAC Incorporated (NYSE:AFL) is the least popular one with only 29 bullish hedge fund positions. Eaton Corporation, PLC Ordinary Shares (NYSE:ETN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DAL might be a better candidate to consider taking a long position in.

Disclosure: None