We know that hedge funds generate strong risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Ackman’s recent Valeant losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Cimarex Energy Co (NYSE:XEC).

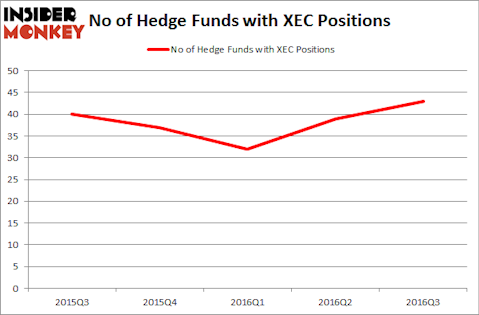

Is Cimarex Energy Co (NYSE:XEC) a safe investment today? It looks like, investors who are in the know are betting on the stock. The number of bullish hedge fund bets rose by four to 43 between July and September. At the end of this article we will also compare XEC to other stocks including Liberty Broadband Corp (NASDAQ:LBRDA), Ferrari N.V. (NYSE:RACE), and Motorola Solutions Inc (NYSE:MSI) to get a better sense of its popularity.

Follow Cimarex Energy Co (NYSE:XEC)

Follow Cimarex Energy Co (NYSE:XEC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

ded pixto/Shutterstock.com

With all of this in mind, let’s take a look at the key action encompassing Cimarex Energy Co (NYSE:XEC).

How have hedgies been trading Cimarex Energy Co (NYSE:XEC)?

At the end of the third quarter, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on Cimarex Energy Co (NYSE:XEC), a up by 10% over the quarter. Below, you can check out the change in hedge fund sentiment towards XEC over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the number one position in Cimarex Energy Co (NYSE:XEC), worth close to $434.6 million, corresponding to 2.7% of its total 13F portfolio. The second largest stake is held by Citadel Investment Group, led by Ken Griffin, which holds a $270 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism comprise Israel Englander’s Millennium Management, Rob Citrone’s Discovery Capital Management, and Steve Cohen’s Point72 Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, specific money managers have been driving this bullishness. Till Bechtolsheimer’s Arosa Capital Management established the most outsized position in Cimarex Energy Co (NYSE:XEC). Arosa Capital Management had $13.1 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $12.9 million position during the quarter. The other funds with brand new XEC positions are Neil Chriss’ Hutchin Hill Capital, Ken Griffin’s Citadel Investment Group, and Ben Gambill’s Tiger Eye Capital.

Let’s go over hedge fund activity in other stocks similar to Cimarex Energy Co (NYSE:XEC). We will take a look at Liberty Broadband Corp (NASDAQ:LBRDA), Ferrari N.V. (NYSE:RACE), Motorola Solutions Inc (NYSE:MSI), and McCormick & Company, Incorporated (NYSE:MKC). All of these stocks’ market caps are closest to XEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRDA | 27 | 399996 | 1 |

| RACE | 16 | 272860 | -1 |

| MSI | 28 | 1170738 | -1 |

| MKC | 21 | 127420 | 3 |

As you can see these stocks had an average of 23 funds with bullish positions and the average amount invested in these stocks was $493 million. That figure was $1.64 billion in XEC’s case. Motorola Solutions Inc (NYSE:MSI) is the most popular stock in this table, while Ferrari N.V. (NYSE:RACE) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Cimarex Energy Co (NYSE:XEC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none