Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Splunk Inc (NASDAQ:SPLK)? The smart money sentiment can provide an answer to this question.

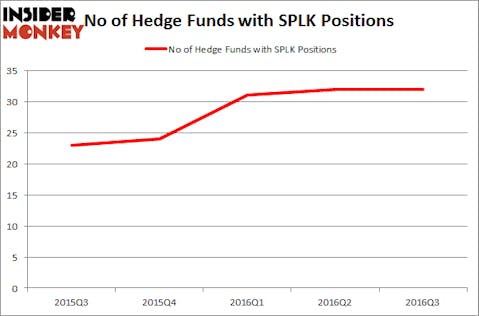

Splunk Inc (NASDAQ:SPLK) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of September. At the end of this article we will also compare SPLK to other stocks including Alaska Air Group, Inc. (NYSE:ALK), Open Text Corporation (USA) (NASDAQ:OTEX), and Western Gas Partners, LP (NYSE:WES) to get a better sense of its popularity.

Follow Splunk Inc (NASDAQ:SPLK)

Follow Splunk Inc (NASDAQ:SPLK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: dizanna / 123RF Stock Photo

Keeping this in mind, let’s go over the fresh action regarding Splunk Inc (NASDAQ:SPLK).

Hedge fund activity in Splunk Inc (NASDAQ:SPLK)

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. Hedge fund sentiment has been largely flat for 2 quarters after a positive spike in Q1. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Criterion Capital, managed by Christopher Lord, holds the number one position in Splunk Inc (NASDAQ:SPLK). Criterion Capital has a $202.6 million position in the stock, comprising 8.1% of its 13F portfolio. Sitting at the No. 2 spot is Coatue Management, managed by Philippe Laffont, which holds a $64.7 million position. Other peers with similar optimism encompass Josh Resnick’s Jericho Capital Asset Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Christopher James’ Partner Fund Management.