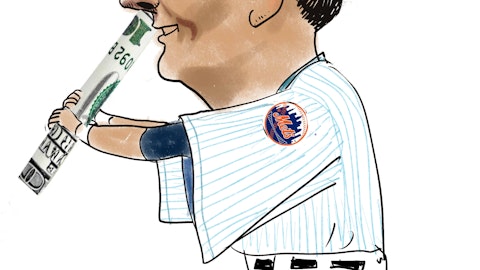

Herbalife Ltd. (NYSE:HLF) has had a wild ride over the past three weeks. On the afternoon of December 19th, news surfaced that Bill Ackman, manager of Pershing Square Capital, was short-selling close to 20% of the stock’s outstanding shares. In the next three and a half days of trading, HLF lost a little over 38% of its value as investors learned more of Ackman’s allegations that the company was a “pyramid scheme.” The stock has, however, bounced back from a Christmas Eve low under $25 a share and now trades just 2.5 percentage points off its December 18th closing price.

Keeping this in mind, much of the positive momentum in Herbalife’s stock price can be attributed to two things: new support from other key players in the hedge fund industry, and serious efforts by the company itself to combat Ackman’s allegations. Regarding the latter, Herbalife Ltd. (NYSE:HLF) has hired notable investment bank Moelis & Co. to serve as an advisor, and it has also put prominent law firm Boies, Schiller & Flexner in its corner.

In terms of support from the smart money, Robert Chapman, manager of Chapman Capital, announced on December 29th that he had close to 35% of his portfolio in the stock. The NYPost also reports that Carl Icahn is “believed to have taken a long position in Herbalife.”

Yesterday (January 9th), Daniel Loeb and Third Point revealed that they hold “about 8% of Herbalife outstanding stock,” adding that it was “acquired mostly during the panicked selling that followed the short seller’s dramatic claims.” Here’s a full look at Loeb’s Q4 investment letter.

From a valuation standpoint, shares currently trade at a forward P/E of 8.7x, and Loeb mentions that “applying a modest 10-12x earnings multiple suggests Herbalife’s shares are worth $55-$68.” At the time of this writing, shares are trading close to the $41 mark. While there’s no telling where this stock will go in the short run–with a bevy of drama to still play out between the company’s legal team and Ackman–Loeb’s reasoning is sound.

In addition to Herbalife Ltd. (NYSE:HLF), the fund manager’s Q4 letter also mentioned three other companies in particular: Murphy Oil Corporation (NYSE:MUR), Morgan Stanley (NYSE:MS) and Tesoro Corporation (NYSE:TSO). Let’s take a brief run through each position, shall we?

Murphy Oil, the oil and gas E&P, was a big position for Loeb at the end of the third quarter, taking the No. 5 spot in his 13F portfolio. All in all, MUR comprises a little over 5% of the money manager’s 13F, which is filed with the SEC quarterly. Check out all of Dan Loeb’s stock picks here.

Loeb mentioned that in his Q3 letter, he had said Murphy “had many routes to unlock latent, meaningful value, among them — and most significantly — a highly accretive spin-off of its retail business.” In the time since, the company has announced that it will spin off its U.S. downstream segment, called Murphy USA, that should be finished by the middle of this year.

Moreover, Loeb mentions that “a $1 billion share repurchase program and a $2.50 per share special dividend” are strides in the right direction for Murphy, adding “we expect the company to announce further moves to address its still-depressed valuation, including sales of its Montney asset and 5% stake in Syncrude.”

Speaking of the valuation, Murphy Oil currently trades at a forward P/E below 11x and a PEG of 1.05, despite the fact that analysts expect its five-year annual EPS growth (12.0%) to trump chief competitor ConocoPhillips (NYSE:COP) (2.6%) significantly. Conoco trades at an earnings growth multiple close to 4.0, and is also far more expensive than Murphy on a sales (1.1x) and cash (55.7x) basis. MUR sports P/S and P/C ratios of 0.4x and 8.9x respectively.

Moving on to Morgan Stanley, a financial services company that Loeb says “currently trades at a 20% discount to tangible book,” there’s a lot to like about it from an investment standpoint. Loeb mentions that Morgan Stanley’s investment banking, trading and equity operations “are impressively positioned,” and in his opinion, “leadership currently is focused on growing its good businesses.”

Earlier this month, we discussed the bank (see Morgan Stanley: Is it the Best Bank to Buy?), and mentioned that it is “one of the top value plays in the industry.” In addition to an attractive book valuation, MS also trades at a forward earnings multiple below 10.0x, and the Street is expecting EPS growth to come in at 14% a year over the next half-decade. This growth rate is above both JPMorgan and Citigroup by a large margin. Joining Loeb in Morgan Stanley is a number of key hedge fund players, including Boykin Curry, Ken Griffin, Steven Cohen and David Tepper, to name a few (see David Tepper’s favorite stock picks here).

Last but certainly not least, Tesoro was a new position for Loeb during the fourth quarter, according to his investment letter. While shares of the petroleum refiner are up over 50% since last last August, Loeb says that “Tesoro remains misunderstood by the market […] current sell-side analyst price targets range from $35 to $84!” The stock currently trades in the $41 range, and sports significantly depressed forward earnings (7.0x) and trailing sales (0.2x) multiples. In terms of bottom-line growth, which is expected to average 14-15% a year through 2017, a PEG near 0.7 indicates that investors are still undervaluing these prospects. A projected dividend yield of 1.45% is a nice cherry on top as well.

For more related coverage, continue reading here:

Why Are Herbalife Shares Gaining Momentum?

Herbalife Isn’t the Only Stock With an Ackman-Tilson Connection

Disclosure: I have no positions in any of the stocks mentioned above